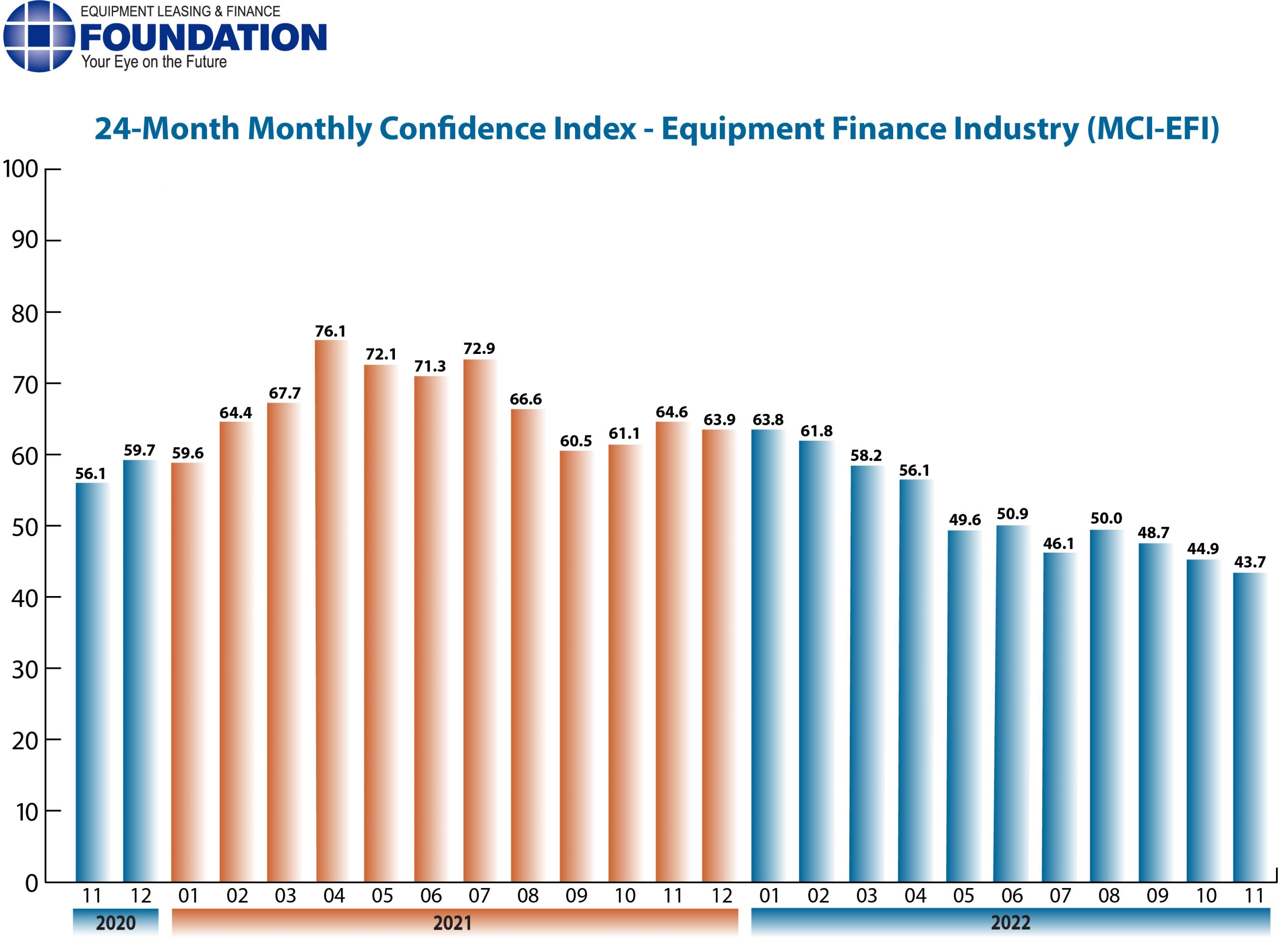

The Equipment Leasing & Finance Foundation (the Foundation) releases the November 2022 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 43.7, a decrease from the October index of 45.

When asked about the outlook for the future, MCI-EFI survey respondent Aylin Cankardes, President, Rockwell Financial Group, said, “There continues to be uncertainty in the markets as a result of inflationary pressures, rising rates, and the unknown impact of mid-term elections. Due to ongoing challenges from supply chain delays, we are seeing increased demand for used equipment. Overall, our customers have been very resilient and underlying growth has been robust so we anticipate a strong finish to 2022, particularly in the energy transition and sustainability finance sector.”

November 2022 Survey Results

The overall MCI-EFI is 43.7, a decrease from the October index of 45.

When asked to assess their business conditions over the next four months, none of the executives responding said they believe business conditions will improve over the next four months, unchanged from October. 46.4% believe business conditions will remain the same over the next four months, down from 62.5% the previous month. 53.6% believe business conditions will worsen, an increase from 37.5% in October.

- 10.7% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from 8.3% in October. 67.9% believe demand will “remain the same” during the same four-month time period, an increase from 66.7% the previous month. 21.4% believe demand will decline, down from 25% in October.

- 14.3% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 4.2% in October. 64.3% of executives indicate they expect the “same” access to capital to fund business, a decrease from 87.5% last month. 21.4% expect “less” access to capital, up from 8.3% the previous month.

- When asked, 32.1% of the executives report they expect to hire more employees over the next four months, up from 29.2% in October. 64.3% expect no change in headcount over the next four months, a decrease from 66.7% last month. 3.6% expect to hire fewer employees, down from 4.2% in October.

- 3.6% of the leadership evaluate the current U.S. economy as “excellent,” a decrease from 8.3% the previous month. 75% of the leadership evaluate the current U.S. economy as “fair,” up from 66.7% in October. 21.4% evaluate it as “poor,” a decrease from 25% last month.

- None of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, unchanged from October. 28.6% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 41.7% last month. 71.4% believe economic conditions in the U.S. will worsen over the next six months, an increase from 58.3% the previous month.

- In November 28.6% of respondents indicate they believe their company will increase spending on business development activities during the next six months, up from 25% the previous month. 64.3% believe there will be “no change” in business development spending, down from 70.8% in October. 7.1% believe there will be a decrease in spending, an increase from 4.2% last month.

Survey Demographics

Market Segment

- Bank 55.6%

- Captive 11.1%

- Independent 33.3%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 10.7%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 46.4%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 42.8%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 10.7%

- $50 Million – $250 Million 21.4%.

- $250 Million – $1 Billion 25%

- Over $1 Billion 42.8%

November 2022 Survey Comments from Industry Executive Leadership

Independent, Small Ticket

“Despite the economic headwinds and rising interest rates there will still be decent demand as equipment that has aged due to supply chain constraints will need to be replaced. We are concerned how the rising costs of borrowing combined with a softening economy will impact some of our leveraged borrowers.” Chris Lerma, President, AP Equipment Financing

Independent, Middle Ticket

“While our customers will pay higher interest rates due to continued policy moves by the Federal Reserve, we don’t expect spending on major capital expenditures to be negatively impacted solely by higher rates. We are, however, on the lookout for slowing in certain sectors that will eventually slow down or delay spending on equipment purchases.” Bruce J. Winter, President, FSG Capital, Inc.

Bank, Middle Ticket

“Supply chain issues look to extend into 2023 delaying equipment purchases. Higher rates are having customers consider leasing options to conserve cash flow.” Michael Romanowski, President, Farm Credit Leasing

[Note: Some MCI survey questionnaires and comments were submitted before Election Day results were publicized.]

Back to Top