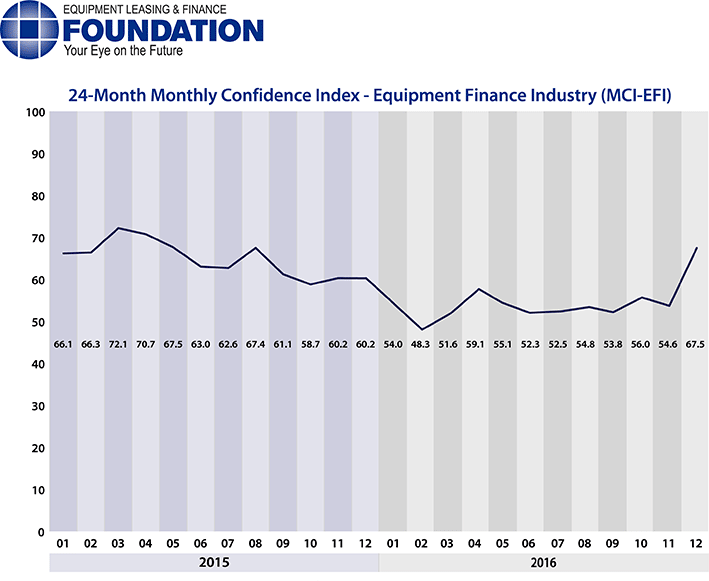

The Equipment Leasing & Finance Foundation (the Foundation) releases the December 2016 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 67.5, a sharp increase from the November index of 54.6, with equipment finance executives expressing post-election optimism.

When asked about the outlook for the future, MCI-EFI survey respondent David Normandin, Managing Director, Commercial Finance Group, Hanmi Bank, said, “I am optimistic as the election cycle is finally behind us, and regardless of the side, people will begin to accept it and move forward. I also think an interest rate increase will be healthy, and I believe that we will see that happen this coming year.”

December 2016 Survey Results

- When asked to assess their business conditions over the next four months, 48.4% of executives responding said they believe business conditions will improve over the next four months, an increase from 13.8% in November. 45.2% of respondents believe business conditions will remain the same over the next four months, a decrease from 69.0% in November. 6.5% believe business conditions will worsen, a decrease from 17.2% the previous month.

- 38.7% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from 13.8% in November. 54.8% believe demand will “remain the same” during the same four-month time period, down from 69.0% the previous month. 6.5% believe demand will decline, down from 17.2% who believed so in November.

- 22.6% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, an increase from 13.8% who expected more in November. 77.4% of executives indicate they expect the “same” access to capital to fund business, a decrease from 82.8% the previous month. None expect “less” access to capital, a decrease from 3.4% last month.

- When asked, 41.9% of the executives report they expect to hire more employees over the next four months, an increase from 34.5% in November. 48.4% expect no change in headcount over the next four months, a decrease from 55.2% last month. 9.7% expect to hire fewer employees, down from 10.3% in November.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from last month. 100.0% of the leadership evaluate the current U.S. economy as “fair,” and none evaluate it as “poor,” both also unchanged from November.

- 71.0% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 17.2% in November. 25.8% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 65.5% the previous month. 3.2% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 17.2% who believed so last month.

- In December, 48.4% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 37.9% in November. 51.6% believe there will be “no change” in business development spending, a decrease from 58.6% the previous month. None believe there will be a decrease in spending, a decrease from 3.4% who believed so last month.

Survey Demographics

Market Segment:

- Bank: 64.5%

- Captive: 9.7%

- Financial Services: 3.2%

- Independent: 22.6%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 19.4%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 41.9%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 38.7%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 3.2%

- $50 Million – $250 Million: 19.4%

- $250 Million – $1 Billion: 32.3%

- Over $1 Billion: 42.2%

December 2016 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Bank, Small Ticket

“The results of the election should lead to a more favorable business environment over time. The anticipation of this has already had a positive impact and is beginning to shift the mindsets of business leaders and investors. I am concerned about the potential negative impact the anticipated tax reform may have on our industry segment.” Robert Boyer, President, Susquehanna Commercial Finance, Inc.

Independent, Small Ticket

“I’m hopeful that we are moving into a more favorable business environment which will create a more optimistic outlook. Certainly having the election behind us is less of a distraction.” David T. Schaefer, CEO, Mintaka Financial, LLC

Bank, Middle Ticket

“A more business friendly administration will provide economic stimulus to all sectors of the economy.” Harry Kaplun, President, Specialty Finance, Frost Bank

Independent, Middle Ticket

“I believe that with the election now over there will be a more stable and hopefully a more positive business environment, which will translate to an increase in financing opportunities.” William H. Besgen, Senior Advisor, Vice Chairman Emeritus, Hitachi Capital America Corp

Back to Top