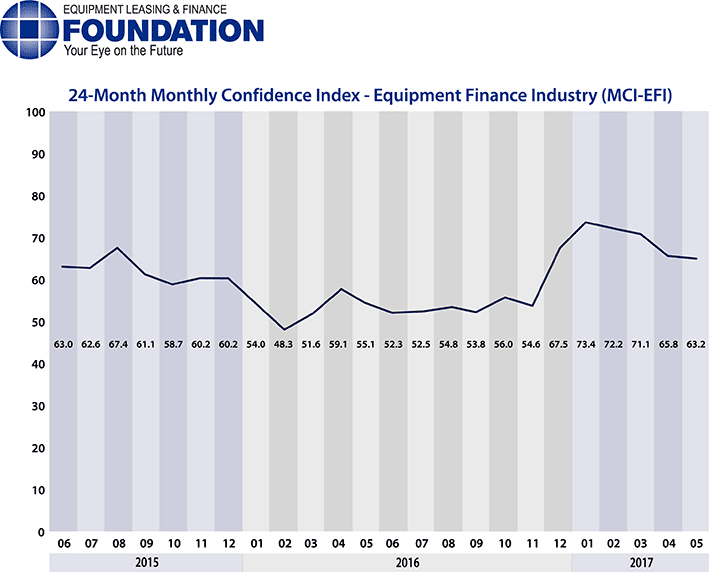

The Equipment Leasing & Finance Foundation (the Foundation) releases the May 2017 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market eased again in May to 63.2, down from the April index of 65.8.

When asked about the outlook for the future, MCI-EFI survey respondent Valerie Hayes Jester, President, Brandywine Capital Associates, said, “Stronger demand has returned to our marketplace. I think the waiting game played by many small businesses in the first quarter has ended and demand is flowing more freely again. The changes to healthcare legislation may slow this down a bit, but I am optimistic that the year will end well.”

May 2017 Survey Results

The overall MCI-EFI is 63.2, a decrease from the April index of 65.8.

- When asked to assess their business conditions over the next four months, 22.6% of executives responding said they believe business conditions will improve over the next four months, a decrease from 36.7% in April. 71% of respondents believe business conditions will remain the same over the next four months, an increase from 63.3% in April. 6.5% believe business conditions will worsen, an increase from none the previous month.

- 38.7% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 40% in April. 54.8% believe demand will “remain the same” during the same four-month time period, down from 56.7% the previous month. 6.5% believe demand will decline, up from 3.3% who believed so in April.

- 12.9% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 16.7% in April. 83.9% of executives indicate they expect the “same” access to capital to fund business, up from 80% last month. 3.2% expect “less” access to capital, unchanged from last month.

- When asked, 45.2% of the executives report they expect to hire more employees over the next four months, an increase from 40% in April. 51.6% expect no change in headcount over the next four months, a decrease from 53.3% last month. 3.2% expect to hire fewer employees, down from 6.7% in April.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from last month. 100% of the leadership evaluate the current U.S. economy as “fair,” and none evaluate it as “poor,” both also unchanged from April.

- 41.9% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 46.7% in April. 51.6% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 53.3% the previous month. 6.5% believe economic conditions in the U.S. will worsen over the next six months, up from none who believed so last month.

- In May, 45.2% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 46.7% in April. 51.6% believe there will be “no change” in business development spending, a decrease from 53.3% the previous month. 3.2% believe there will be a decrease in spending, up from none last month.

Survey Demographics

MARKET SEGMENT:

- Bank: 70%

- Captive: 3.3%

- Financial Services: 0%

- Independent: 23.3%

- Other: 3.3%

MARKET SEGMENTS BASED ON TRANSACTION SIZE OF NEW BUSINESS VOLUME

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 20.0%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 43.3%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 36.7%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

ORGANIZATION SIZE:

- Under $50 Million: 6.7%

- $50 Million – $250 Million: 16.7%

- $250 Million – $1 Billion: 33.3%

- Over $1 Billion: 43.3%

May 2017 Survey Comments from Industry Executive Leadership

The overall MCI-EFI is 65.8, a decrease from the March index of 71.1.

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

BANK, MIDDLE TICKET

“The historically slow but steady economic growth should get a boost from tax reform.” Harry Kaplun, President, Specialty Finance, Frost Bank

BANK, MIDDLE TICKET

“We saw a definitive change in client attitude regarding capex spending in the past 30 days resulting in pipeline declines for both tax and non-tax financing. We believe that this is fueled by a very uncertain political climate. The financing industry is thus impacted by the fact that most institutions have high capital levels with a need to invest it, leading to lower return on equity and higher risk profiles as a result of chasing too few opportunities in the marketplace.” Frank J. Campagna, Group Vice President, Line of Business Manager, M&T Bank Commercial Equipment Finance

BANK, LARGE TICKET

“Rates still remain good by historical standards. The lack of movement in tax reform and healthcare policy is impacting investment decisions.” Thomas Partridge, President, Fifth Third Equipment Finance

Back to Top