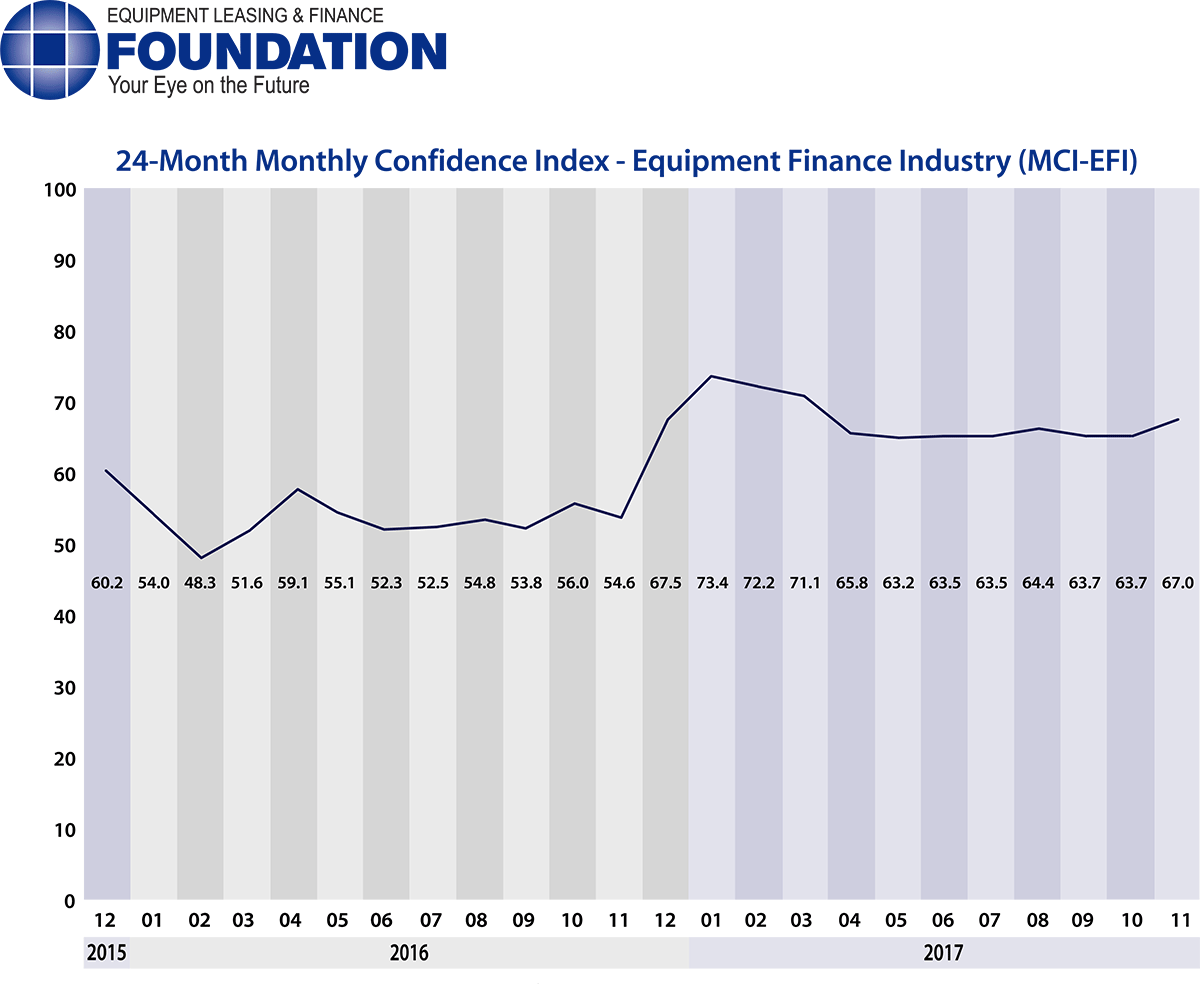

The Equipment Leasing & Finance Foundation (the Foundation) releases the November 2017 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 67.0 in November, an increase from 63.7 in October.

When asked about the outlook for the future, MCI-EFI survey respondent Thomas Jaschik, President, BB&T Equipment Finance, said, “The House is considering its tax reform package which includes a reduction in the corporate tax rate to 20 percent. The assumption is that this will allow companies to invest more fully in their businesses. If this holds true, the tax package would be the catalyst to accelerate growth in our industry. Over the next several years the equipment finance industry could achieve record levels of new business production.”

November 2017 Survey Results

The overall MCI-EFI is 67.0 in November, up from 63.7 in October.

- When asked to assess their business conditions over the next four months, 32.4% of executives responding said they believe business conditions will improve over the next four months, a decrease from 40% in October. 67.7% of respondents believe business conditions will remain the same over the next four months, an increase from 60% in October. None believe business conditions will worsen, unchanged from the previous month.

- 35.3% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 36.7% in October. 64.7% believe demand will “remain the same” during the same four-month time period, up from 60% the previous month. None believe demand will decline, a decrease from 3.3% who believed so in October.

- 29.4% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 20% in October. 67.7% of executives indicate they expect the “same” access to capital to fund business, down from 80% last month. None expect “less” access to capital, unchanged from last month.

- When asked, 35.5% of the executives report they expect to hire more employees over the next four months, an increase from 33.3% in October. 61.8% expect no change in headcount over the next four months, a decrease from 63.3% last month. 2.9% expect to hire fewer employees, a decrease from 3.3% in October.

- 17.7% of the leadership evaluate the current U.S. economy as “excellent,” up from none last month. 82.4% of the leadership evaluate the current U.S. economy as “fair,” a decrease from 100% in October. None evaluate it as “poor,” unchanged from last month.

- 32.5% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 23.3% in October. 64.7% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 76.7% the previous month. 2.9% believe economic conditions in the U.S. will worsen over the next six months, an increase from none who believed so in October.

- In November, 52.9% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 36.7% in October. 47.1% believe there will be “no change” in business development spending, a decrease from 63.3% the previous month. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment

- Bank 68.75%

- Captive 6.25%

- Financial Services 0.00%

- Independent 21.88%

- Other (please specify) 3.13%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 18.75%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 50.00%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 31.25%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0.00%

Organization Size

- Under $50 Million 6.25%

- $50 Million – $250 Million 12.50%

- $250 Million – $1 Billion 31.25%

- Over $1 Billion 50.00%

November 2017 Survey Comments from Industry Executive Leadership

Independent, Small Ticket

“We continue to see a steady flow of good quality transactions. Our average customer is still concerned with the lack of direction on tax issues and healthcare reform. Until there is clarity, we don’t expect to see a large volume of business expansion projects. There’s just too much unknown to fund transactions with leverage.” Valerie Hayes Jester, President, Brandywine Capital Associates

Bank, Small Ticket

“I am concerned about the ongoing lack of results from Washington and the effects that this will have on the confidence of the business community over time.” David Normandin, CLFP, Managing Director, Commercial Finance Group, Hanmi Bank

Bank, Middle Ticket

“The positive economic tide is raising all ships. Low default levels, low interest rates and the continuing demand for equipment are all adding to the favorable environment.” Harry Kaplun, President, Specialty Finance, Frost Bank

Back to Top