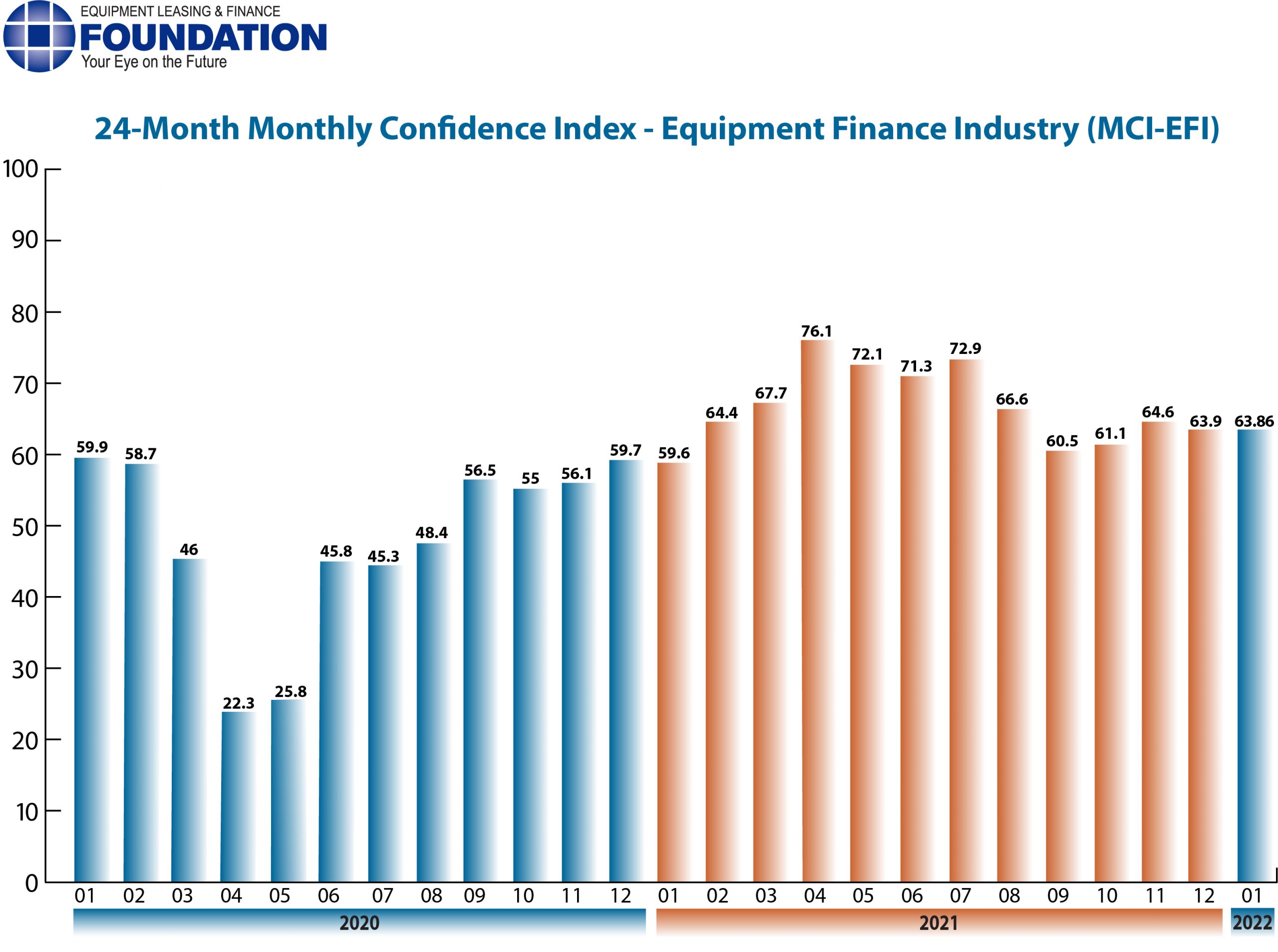

The Equipment Leasing & Finance Foundation (the Foundation) releases the January 2022 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 63.9, unchanged from the December index.

When asked about the outlook for the future, MCI-EFI survey respondent Jim DeFrank, EVP and Chief Operating Officer, Isuzu Finance of America, Inc., said, “It’s all about supply chain right now. There is demand for equipment, but manufactures are having a hard time satisfying the demand due to parts shortages, workforce issues, etc. Once the supply can match demand, we will see a nice increase in finance and leasing volumes. Hopefully, by the second half of 2022.”

January 2022 Survey Results

The overall MCI-EFI is 63.9, unchanged from the December index.

- When asked to assess their business conditions over the next four months, 25.9% of executives responding said they believe business conditions will improve over the next four months, a decrease from 34.6% in December. 70.4% believe business conditions will remain the same over the next four months, up from 61.5% the previous month. 3.7% believe business conditions will worsen, unchanged from December.

- 25.9% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 26.9% in December. 70.4% believe demand will “remain the same” during the same four-month time period, a decrease from 73.1% the previous month. 3.7% believe demand will decline, up from none in December.

- 21.4% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 19.2% in December. 78.6% of executives indicate they expect the “same” access to capital to fund business, a decrease from 80.8% last month. None expect “less” access to capital, unchanged from the previous month.

- When asked, 39.3% of the executives report they expect to hire more employees over the next four months, down from 42.3% in December. 60.7% expect no change in headcount over the next four months, an increase from 57.7% last month. None expect to hire fewer employees, unchanged from December.

- 14.8% of the leadership evaluate the current U.S. economy as “excellent,” a decrease from 19.2% the previous month. 81.5% of the leadership evaluate the current U.S. economy as “fair,” up from 76.9% in December. 3.7% evaluate it as “poor,” unchanged from last month.

- 29.6% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 19.2% in December. 63% indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 61.5% last month. 7.4% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 19.2% the previous month.

- In January 50% of respondents indicate they believe their company will increase spending on business development activities during the next six months, up from 46.2% the previous month. 50% believe there will be “no change” in business development spending, down from 53.9% in December. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment

- Bank 55.5%

- Captive 18.5%

- Independent 26%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 18.9%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 46.4%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 35.7%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 7.1%

- $50 Million – $250 Million 28.5%.

- $250 Million – $1 Billion 21.4%

- Over $1 Billion 42.8%

January 2022 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“2022 will be an interesting year with many challenges and headwinds that will create opportunities for organizations that are positioned well and are nimble enough to take advantage.” David Normandin, CLFP, President and CEO, Wintrust Specialty Finance

Bank, Middle Ticket

“Supply chain issues continue to be our biggest headwind. With the Fed anticipating raising interest rates, we expect customers to lock in long-term financing at today’s low rates.” Michael Romanowski, President, Farm Credit Leasing

Independent, Middle Ticket

“While the seemingly never-ending pandemic, fueled by the Omicron variant, is creating havoc in certain sectors, the industry enjoyed a strong year in FY 2021 and is positioned to prosper again in FY 2022. Strong underwriting will be rewarded, and those that took too much risk may begin feeling the impact of deteriorating portfolio performance as government stimulus runs out. Competition will keep spreads tight, but increasing costs of funds will force lenders to slowly raise pricing throughout the year.” Bruce J. Winter, President, FSG Capital, Inc.

Back to Top