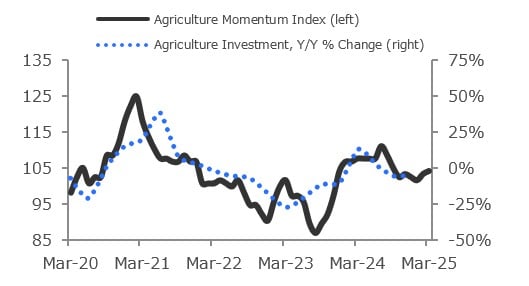

Agricultural Machinery

Investment in Agricultural Machinery fell 28% (annualized) in Q4 2024 and is now 6.3% below its year-ago level. The Agriculture Machinery Momentum Index ticked up from 103.4 to 104.3 in March. While industrial production for agricultural machinery increased 0.3% M/M in January, hog exports fell 66% M/M in December and precipitation in both the South and West fell sharply in January. Overall, recent movement in the Index suggests that annual growth in agriculture machinery investment will remain weak over the next six months.

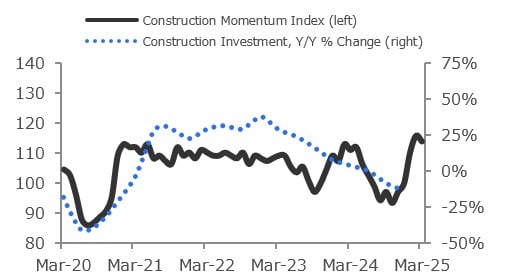

Construction Machinery

Investment in Construction Machinery decreased 18% (annualized) in Q4 2024 and is 14% below its year-ago level. The Construction Machinery Momentum Index slipped from 115.9 in February to 114.0 in March. New homes under construction fell 9.8% in January and the number of overtime hours worked also fell. Despite this month’s slippage, the current position and recent movement of the Index suggest that annual growth in construction machinery investment has likely bottomed out and should improve over the next six months.

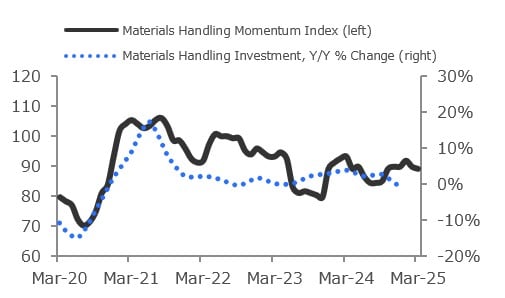

Materials Handling Equipment

Investment in Materials Handling Equipment decreased 5.7% (annualized) in Q4 2024 and is down 0.9% on a year-over-year basis. The Materials Handling Equipment Momentum Index ticked down from 89.8 in February to 89.1 in March. While the ISM Supplier Deliveries Index rose 3.6 points in February, durable goods machinery sales fell 4.3% M/M in January and is down 1.6% Y/Y. Overall, the Index points to weak but positive annual growth in materials handling equipment investment over the next two quarters

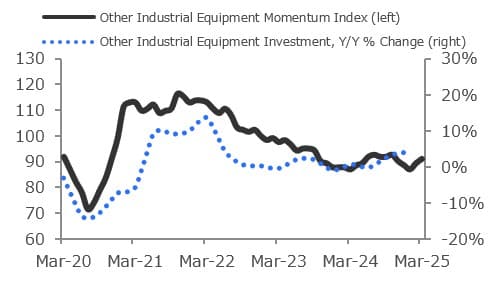

Other Industrial Equipment

Investment in All Other Industrial Equipment increased 1.6% (annualized) in Q4 2024 and is 3.9% above year-ago levels. The Other Industrial Equipment Momentum Index rose from 89.4 to 91.1 in March. In January, industrial production prices rose 0.5% M/M, which more than offset the impact of a 4.0% Y/Y decline in machinery inventories. Overall, the Index’s continues to point to weak annual growth in industrial equipment investment over the next six months.

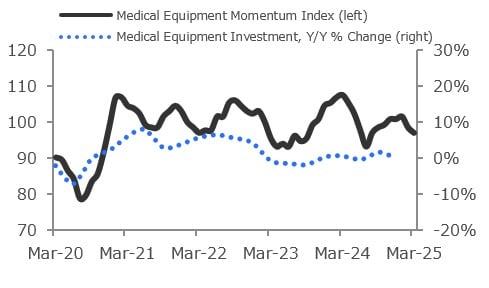

Medical Equipment

Investment in Medical Equipment increased 4.1% (annualized) in Q4 2024 and is essentially flat on a Y/Y basis. The Medical Equipment Momentum Index slipped from 98.5 in February to 97.0 in March. In January, the CPI for dental services fell 0.6% M/M, more than offsetting a 2.1% Y/Y increase in the CPI for physician services. Overall, the Index’s recent movement suggests that annual investment growth in medical equipment may turn negative over the next two quarters.

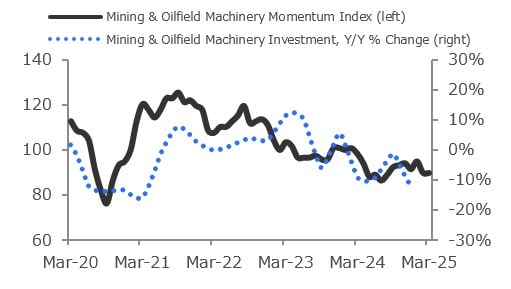

Mining & Oilfield Machinery

Investment in Mining & Oilfield Machinery fell at an 8.5% annualized rate in Q4 2024 and is 13% below year-ago levels. The Mining & Oilfield Machinery Momentum Index held steady at 89.8 in March. Crude oil production rose 4.1% in December while crude oil prices rose $5.48 in January, offsetting the impact of a 9.6% decline in new orders of mining and oilfield machinery goods. Overall, the Index points to a continued contraction in annual investment growth in mining & oilfield machinery over the next six months.

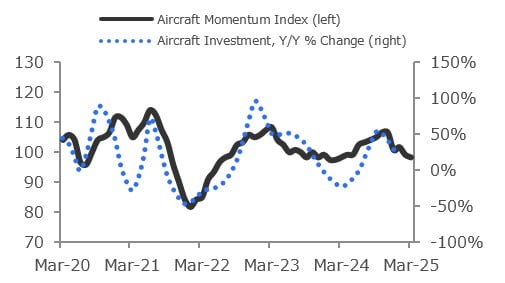

Aircraft

Investment in Aircraft decreased 72% (annualized) in Q4 2024 but is 27% above its year-ago levels. The Aircraft Momentum Index edged down from 99.2 in February to 98.3 in March. Although aerospace equipment prices improved 6.0% in January, the ISM New Orders Index fell 0.9 points in February. Overall, the Index’s steady decline in recent months suggests that annual growth in aircraft investment likely peaked in Q4 and will continue to slow over the next two quarters.

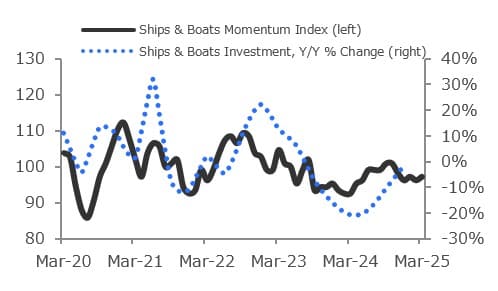

Ships & Boats

Investment in Ships & Boats rose 19% (annualized) in Q4 2024 and is down 1.1% on an annual basis. The Ships & Boats Momentum Index increased from 96.2 in February to 97.2 in March. Inventories of ships and boats increased 4.2% in January, while traffic at the Port of Long Beach increased 11%. Overall, the Index suggests that annual investment growth in ships and boats is likely to remain muted over the next six months.

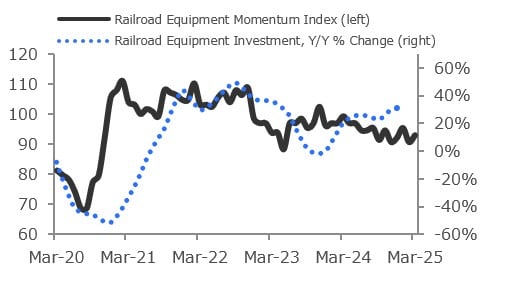

Railroad Equipment

Investment in Railroad Equipment increased 24% (annualized) in Q4 2024 and is up 31% year-over-year. The Railroad Equipment Momentum Index rose from 90.6 to 92.9 in March. In February, while rail carloads of grain fell 5.4% M/M, the ISM Supplier Deliveries Index improved 3.6 points to 54.5. Overall, the Index’s recent movement suggests slower but still solid annual growth in railroad equipment investment over the next two quarters.

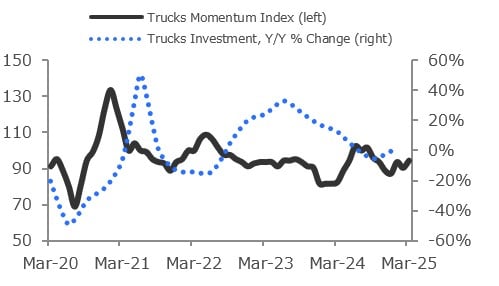

Trucks

Investment in Trucks increased 15% (annualized) in Q4 2024 and is down 0.3% on a year-over-year basis. The Trucks Momentum Index increased from 90.4 to 94.4 in March. Capacity utilization for furniture and related products improved nearly a full percentage point in January while light truck sales rose 4.8%, more than offsetting a 7.7% decline in industrial production of light trucks. Overall, the Index suggests that annual investment growth in trucks should improve modestly over the next six months.

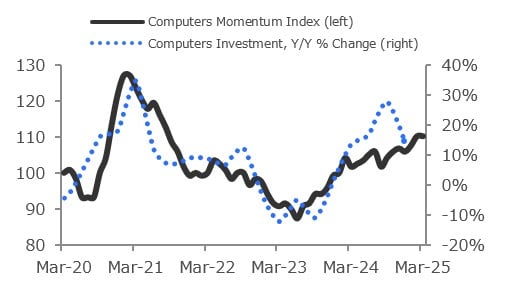

Computers

Investment in Computers decreased 20% (annualized) in Q4 2024 but is up 15% from a year prior. The Computers Momentum Index remained unchanged at 110.2 in March. In January, industrial production rose 0.5% M/M and the ISM supplier deliveries index improved 0.4 points, offsetting a 9.3-point decline in the Conference Board’s Consumer Expectations Index. Despite surprisingly weak investment growth in Q4, the Index continues to point to strong annual investment growth in computers over the next two quarters.

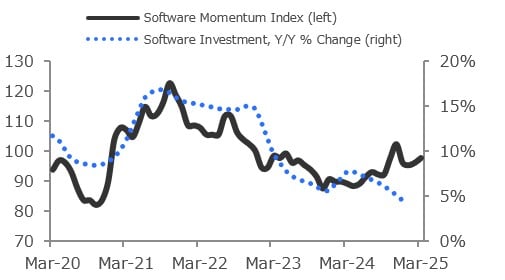

Software

Investment in Software increased 2.7% (annualized) in Q4 2024 and is 4.5% above year-ago levels. The Software Momentum Index rose from 96.1 to 97.7 in March. The ISM Supplier Deliveries Index improved 0.4 points to 43.4 in February while Industrial Production improved 0.5% M/M in January, more than offsetting an 8.4% decline in average weekly earnings for computer and software merchant wholesalers. Overall, the Index points to improved annual growth in software investment over the next six months.