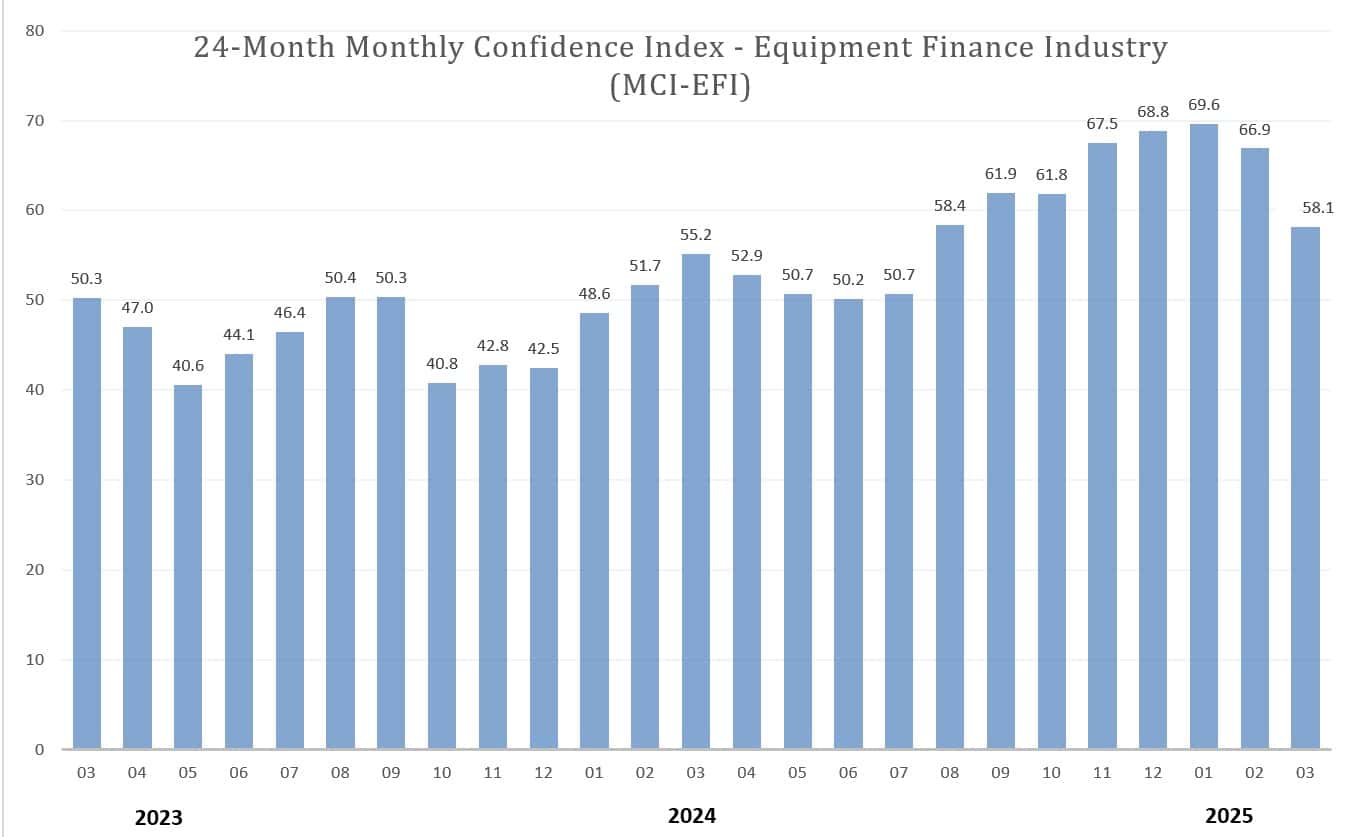

Washington, DC, March 20, 2025 – The Equipment Leasing & Finance Foundation (the Foundation) releases the March 2025 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Overall, confidence in the equipment finance market is 58.1, down from the February index of 66.9, and the lowest index since July 2024. The index reports a qualitative assessment of both the prevailing business conditions and future expectations as reported by key executives from the $1.3 trillion equipment finance sector.

When asked about the outlook for the future, MCI-EFI survey respondent Donna Yanuzzi, EVP and Head of Equipment Finance, 1st Equipment Finance, Inc., said, “Weeding through the noise, the Trump administration appears to be pro-business and regulatory realistic. This combination should drive investment and growth. However, the concerns of tariffs may impact business growth in some fashion. Now, more than ever, strategic planning will be key in navigating the opportunities and risks ahead.”

March 2025 Survey Results

The overall MCI-EFI is 58.1, down from the February index of 66.9.

- Business conditions – When asked to assess their business conditions over the next four months, 28.6% of the executives responding said they believe business conditions will improve over the next four months, a decrease from 53.6% in February. 53.6% believe business conditions will remain the same over the next four months, up from 35.7% the previous month. 17.9% believe business conditions will worsen, up from 7% in February.

- Capex demand – 1% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 46.4% in February. 42.9% believe demand will “remain the same” during the same four-month time period, down from 50% the previous month. 25% believe demand will decline, an increase from 3.6% in February.

- Access to capital – 21.4% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 25% in February. 75% of executives indicate they expect the “same” access to capital to fund business, unchanged from the previous month. 3.6% expect “less” access to capital, up from none in February.

- Employment – When asked, 32.1% of the executives report they expect to hire more employees over the next four months, a decrease from 35.7% in February. 67.9% expect no change in headcount over the next four months, down from 64.3% last month. None expect to hire fewer employees, unchanged from February.

- U.S. economy – 3.6% of the leadership evaluate the current U.S. economy as “excellent,” 92.9% evaluate the economy as “fair,” and 3.6% evaluate it as “poor,” all unchanged from last month.

- Economic outlook – 1% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, down from 48.2% in February. 39.3% indicate they believe the U.S. economy will “stay the same” over the next six months, down from 40.7% last month. 28.6% believe economic conditions in the U.S. will worsen over the next six months, an increase from 11.1% the previous month.

- Business development spending – In March, 35.7% of respondents indicate they believe their company will increase spending on business development activities during the next six months, down from 39.3% the previous month. 64.3% believe there will be “no change” in business development spending, an increase from 60.7% in February. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment

- Bank 53.8%

- Captive 15.3%

- Independent 30.7%

- Other 0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 11.1%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 40.4%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 48.1%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 7.4%

- $50 Million – $250 Million 18.5%.

- $250 Million – $1 Billion 44.4%

- Over $1 Billion 29.6%

March 2025 Survey Comments from Industry Executive Leadership

Captive, Small Ticket

“If imported equipment becomes more expensive, businesses may turn to local suppliers, and with capital expenditures rising, finance and leasing could become more attractive.” Jim DeFrank, EVP and Chief Operating Officer, Isuzu Finance of America, Inc.

Independent, Small Ticket

“We remain cautiously optimistic that the steady demand we are seeing will continue throughout the spring along with maintaining stable portfolio performance. The rapid pace and breadth of the changes by the new administration do cause us some concerns as to how those will affect consumer confidence and spending, labor markets, and overall GDP growth.” Daryn Lecy, CLFP, Chief Operating Officer, Oakmont Capital Services

“Keeping inflation down is very important for an economic recovery.” James D. Jenks, CEO, Global Finance and Leasing Services, LLC

Independent, Large Ticket

“It’s hard to form clear opinions right now, but I am optimistic about the resiliency of the economy overall.” Jonathan Albin, Chief Operating Officer, Nexseer Capital

Back to Top