Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor

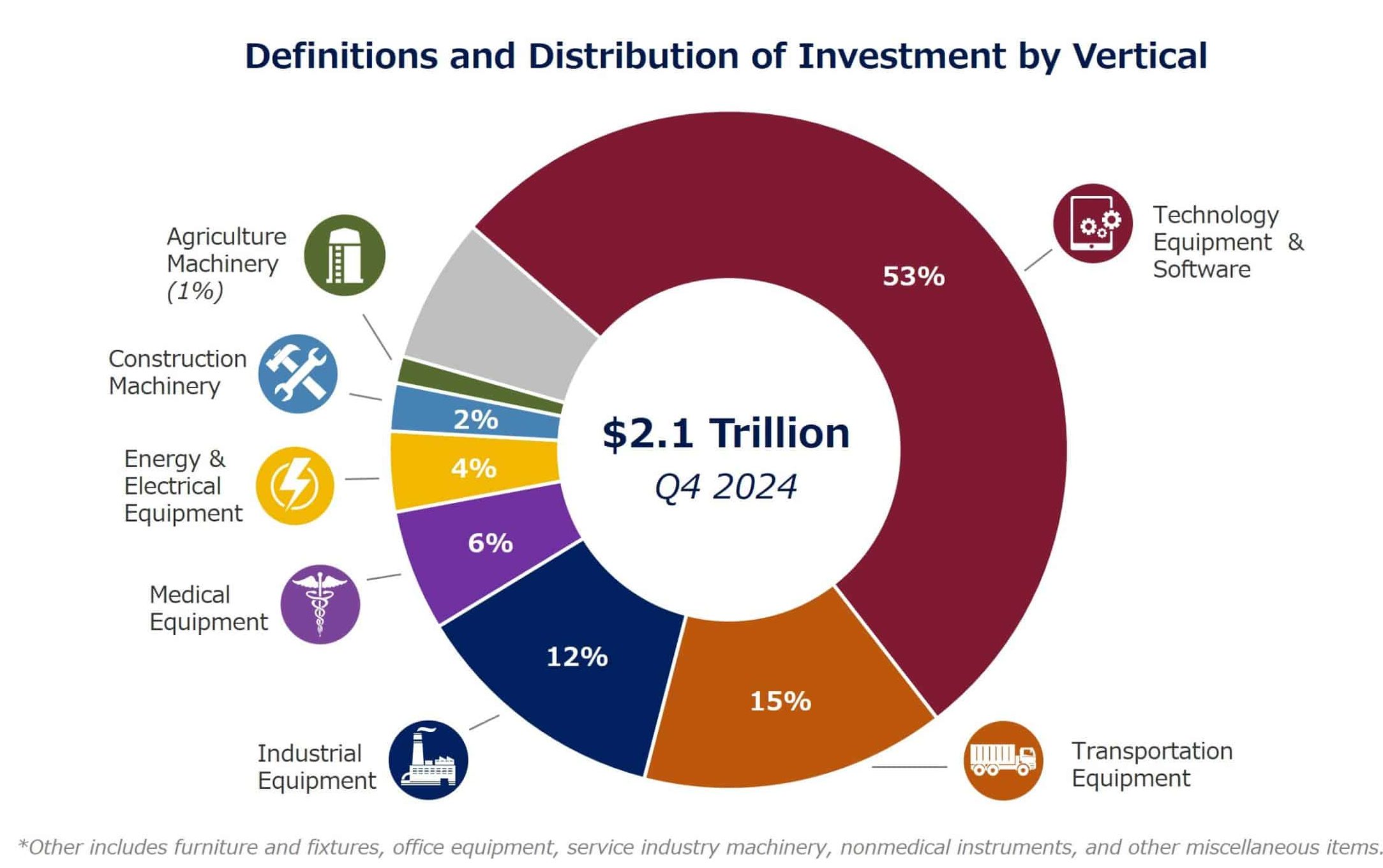

The Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor consists of indices for seven equipment and software investment verticals.

These indices are designed to identify turning points in their respective investment cycles with a 3 to 6 month lead time for the following verticals:

What's New in Q2 for the Momentum Monitor

The Foundation-Keybridge Momentum Monitor has been reimagined with a redesigned report format. Each vertical now receives its own dedicated page, offering more detail through enhanced charts, data tables, and visualizations. The result is a more accessible and visually compelling resource that delivers clear insights and greater value to the industry.

The Foundation consolidated several equipment verticals while also incorporating new types of equipment that have not previously been tracked. Specifically, the number of equipment verticals has been condensed from 12 to 7, including Agriculture, Construction, Energy & Electrical, Industrial, Medical, Technology, and Transportation. Collectively, these verticals account for over 90% of U.S. equipment and software investment. Download the report for more details on each of these verticals.