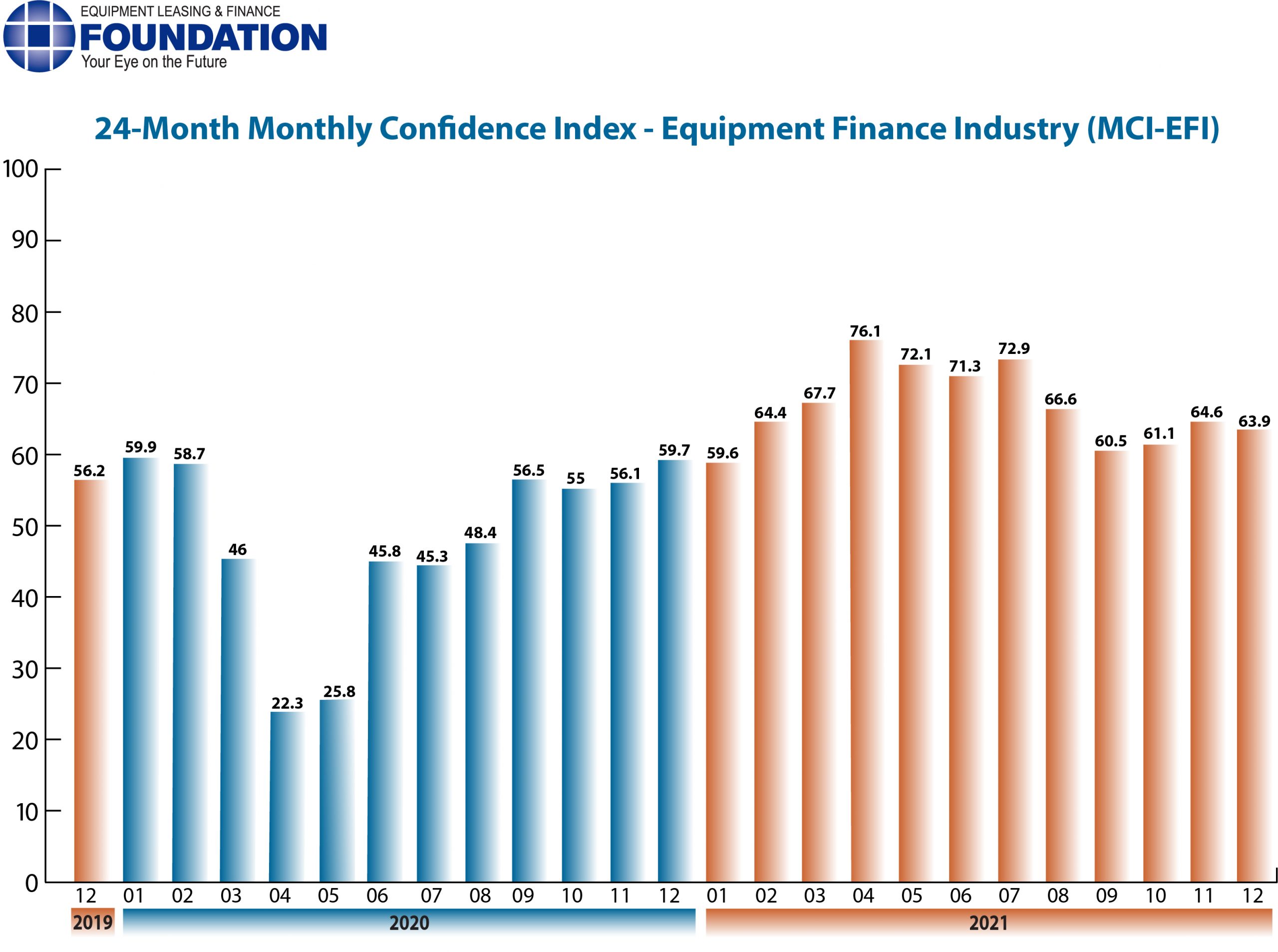

The Equipment Leasing & Finance Foundation (the Foundation) releases the December 2021 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 63.9, a decrease from the November index of 64.6.

When asked about the outlook for the future, MCI-EFI survey respondent Daniel J. Krajewski, President and CEO, Sertant Capital, LLC, said, “The near-term future of the equipment finance industry shows promise for continued expansion. As infrastructure bills are passed and implemented there will be a demand for many asset classes from construction through IT platforms. This, of course, will need to be supported by increased manufacturing capacity to build all the required capital goods. I do have concerns about the political atmosphere that currently exists in the U.S. that may slow down or even kill the entire infrastructure bill, and secondly, the supply chain issues that have bottlenecked the product delivery system.”

December 2021 Survey Results

The overall MCI-EFI is 63.9, a decrease from the November index of 64.6.

- When asked to assess their business conditions over the next four months, 34.6% of executives responding said they believe business conditions will improve over the next four months, unchanged from November. 61.5% believe business conditions will remain the same over the next four months, up from 46.2% the previous month. 3.9% believe business conditions will worsen, down from 19.2% in November.

- 26.9% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 42.3% in November. 73.1% believe demand will “remain the same” during the same four-month time period, an increase from 50% the previous month. None believe demand will decline, down from 7.7% in November.

- 19.2% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 26.9% in November. 80.8% of executives indicate they expect the “same” access to capital to fund business, an increase from 73.1% last month. None expect “less” access to capital, unchanged from the previous month.

- When asked, 42.3% of the executives report they expect to hire more employees over the next four months, down from 53.9% in November. 57.7% expect no change in headcount over the next four months, an increase from 46.2% last month. None expect to hire fewer employees, unchanged from November.

- 19.2% of the leadership evaluate the current U.S. economy as “excellent,” an increase from 15.4% the previous month. 76.9% of the leadership evaluate the current U.S. economy as “fair,” down from 80.8% in November. 3.9% evaluate it as “poor,” unchanged from last month.

- 19.2% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 23.1% in November. 61.5% indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 57.7% last month. 19.2% believe economic conditions in the U.S. will worsen over the next six months, unchanged from the previous month.

- In December 46.2% of respondents indicate they believe their company will increase spending on business development activities during the next six months, up from 42.3% the previous month. 53.9% believe there will be “no change” in business development spending, down from 57.7% in November. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment

- Bank 61.5%

- Captive 11.5%

- Independent 27%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 23.1%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 42.3%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 34.6%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 7.7%

- $50 Million – $250 Million 27%.

- $250 Million – $1 Billion 23%

- Over $1 Billion 42.3%

December 2021 Survey Comments from Industry Executive Leadership

Bank, Middle Ticket

“Demand for capital expenditures remains robust. Customers are looking to mitigate labor shortage challenges with automation. We believe this trend will continue through 2022 and into 2023. Supply chain headwinds continue to frustrate automation plans.” Michael Romanowski, President, Farm Credit Leasing

“Demand for equipment loans and leases remains strong in nearly all sectors. Large U.S. businesses are looking to fixed-rate financing as a strategy to mitigate the impact of inflation.” Alan Sikora, CLFP, CEO, First American, an RBC / City National Company

“Our clients remain resilient, powering though the pandemic, supply chain issues and inflation to meet their objectives. Key remains vigilant that the continued battle against Covid will eventually lessen the risks to our customers and our economy.” Adam Warner, President, Key Equipment Finance

Independent, Middle Ticket

“There is still significant liquidity in the markets and productivity continues to thrive. The impact of inflation and upcoming rate hikes could provide pause, but we continue to see strong demand on capital equipment expenditures. The biggest hurdle is prolonged supply chain disruptions, but it’s encouraging to see organizations transforming to address them innovatively going into 2022.” Aylin Cankardes, President, Rockwell Financial Group

Back to Top