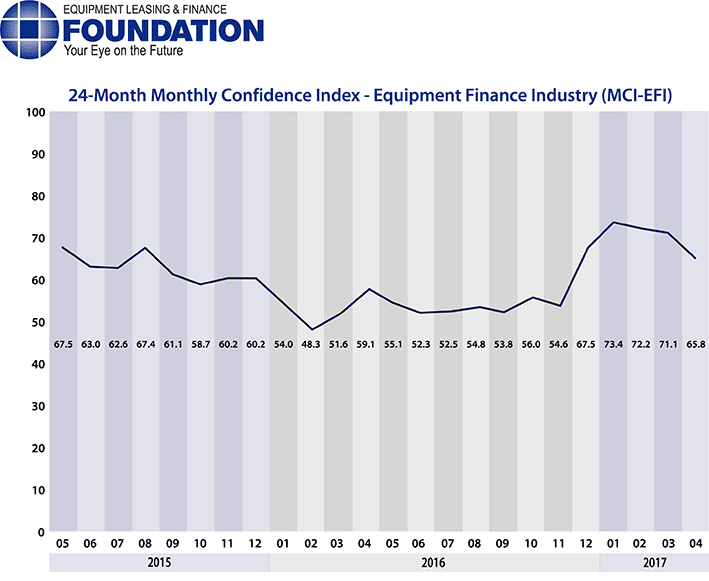

The Equipment Leasing & Finance Foundation (the Foundation) releases the April 2017 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 65.8, easing from the March index of 71.1.

When asked about the outlook for the future, MCI-EFI survey respondent Paul Menzel, President & CEO, Financial Pacific Leasing, Inc., an Umpqua Bank Company, said, “I believe our industry is in a good place given portfolio performance, access to capital and general economic stability. However, the supply and demand imbalance is causing spreads to stay compressed and credit requirements to be relaxed in order to meet growth expectations. This equation is not healthy in the long run.”

April 2017 Survey Results

The Equipment Leasing & Finance Foundation (the Foundation) releases the April 2017 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 65.8, easing from the March index of 71.1.

When asked about the outlook for the future, MCI-EFI survey respondent Paul Menzel, President & CEO, Financial Pacific Leasing, Inc., an Umpqua Bank Company, said, “I believe our industry is in a good place given portfolio performance, access to capital and general economic stability. However, the supply and demand imbalance is causing spreads to stay compressed and credit requirements to be relaxed in order to meet growth expectations. This equation is not healthy in the long run.”

Survey Demographics

Market Segment:

Bank: 66.7%

Captive: 6.7%

Financial Services: 3.3%

Independent: 23.3%

Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 20.0%

Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 40.0%

Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 40.0%

Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size:

Under $50 Million: 6.7%

$50 Million – $250 Million: 16.7%

$250 Million – $1 Billion: 30.0%

Over $1 Billion: 46.7%

April 2017 Survey Comments from Industry Executive Leadership

The overall MCI-EFI is 65.8, a decrease from the March index of 71.1.

When asked to assess their business conditions over the next four months, 36.7% of executives responding said they believe business conditions will improve over the next four months, a decrease from 70% in March. 63.3% of respondents believe business conditions will remain the same over the next four months, an increase from 20% in March. None believe business conditions will worsen, a decrease from 10% the previous month.

40% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 70% in March. 56.7% believe demand will “remain the same” during the same four-month time period, up from 20% the previous month. 3.3% believe demand will decline, down from 10% who believed so in March.

16.7% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, unchanged from March. 80% of executives indicate they expect the “same” access to capital to fund business, and 3.3% expect “less” access to capital, both also unchanged from last month.

When asked, 40% of the executives report they expect to hire more employees over the next four months, a decrease from 43.3% in March. 53.3% expect no change in headcount over the next four months, unchanged from last month. 6.7% expect to hire fewer employees, up from 3.3% in March.

None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from last month. 100% of the leadership evaluate the current U.S. economy as “fair,” and none evaluate it as “poor,” both also unchanged from March.

46.7% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 60% in March. 53.3% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 36.7% the previous month. None believe economic conditions in the U.S. will worsen over the next six months, down from 3.3% who believed so last month.

In April, 46.7% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 50% in March. 53.3% believe there will be “no change” in business development spending, an increase from 50% the previous month. None believe there will be a decrease in spending, unchanged from last month.

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Back to Top