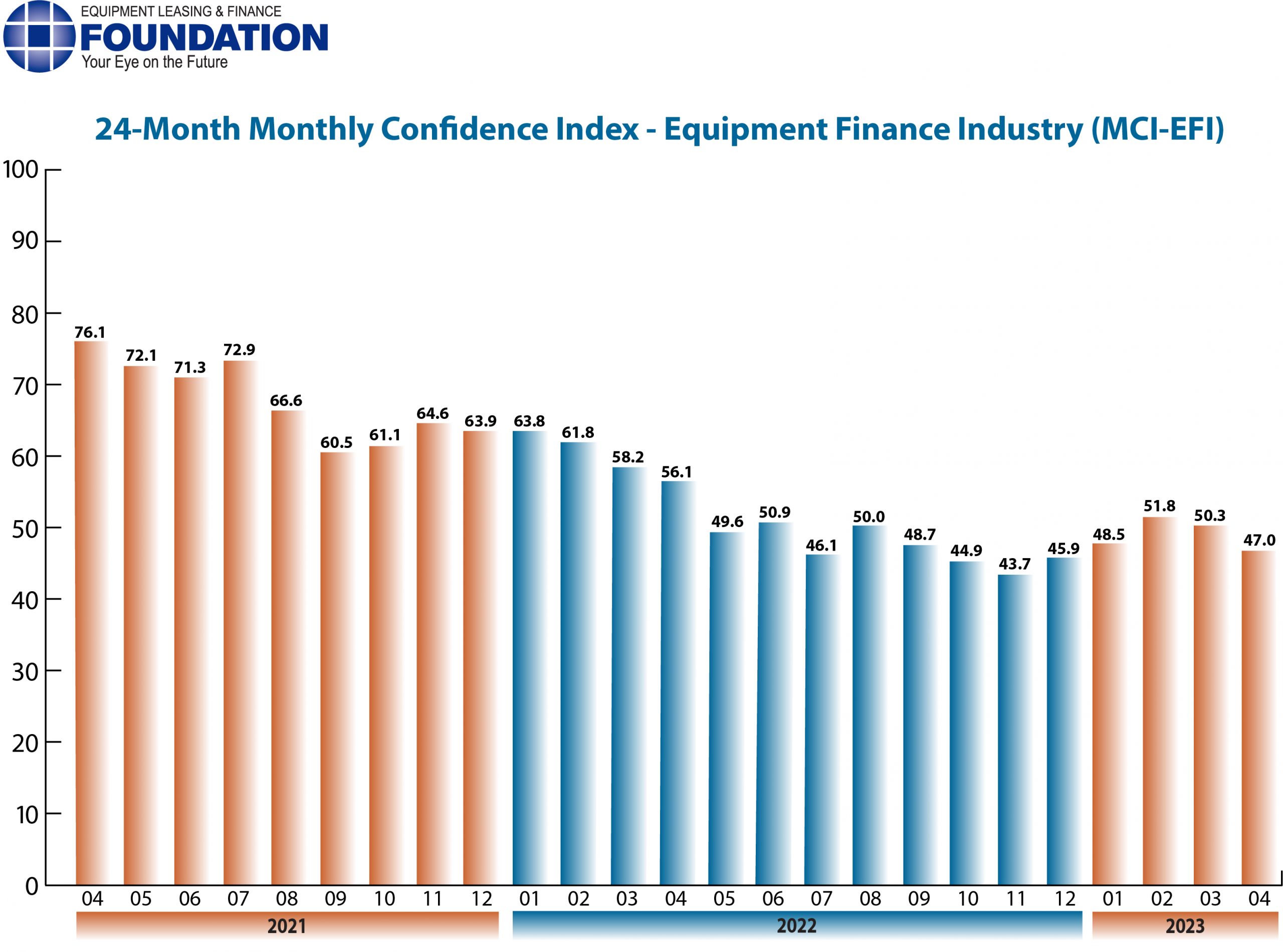

– The Equipment Leasing & Finance Foundation (the Foundation) releases the April 2023 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 47.0, a decrease from the March index of 50.3.

When asked about the outlook for the future, MCI-EFI survey respondent Jonathan Albin, Chief Operating Officer, Nexseer Capital, said, “I believe current market conditions present opportunities for our industry. Businesses have to react to the risk of tightening credit markets. As a result, they will be more open to exploring alternatives and supplements to their senior lending facilities to finance capex and source liquidity, and that will lead to opportunities for lessors.”

April 2023 Survey Results

The overall MCI-EFI is 47.0, a decrease from the March index of 50.3.

- When asked to assess their business conditions over the next four months, 11.1% of the executives responding said they believe business conditions will improve over the next four months, a slight increase from 10.7% in March. 70.4% believe business conditions will remain the same over the next four months, up from 57.1% the previous month. 18.5% believe business conditions will worsen, a decrease from 32.1 % in March.

- 3.7% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 10.7% in March. 70.4% believe demand will “remain the same” during the same four-month time period, an increase from 67.9% the previous month. 25.9% believe demand will decline, up from 21.4% in March.

- 7.4% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 17.9% in March. 77.8% of executives indicate they expect the “same” access to capital to fund business, an increase from 71.4% last month. 14.8% expect “less” access to capital, up from 10.7% the previous month.

- When asked, 33.3% of the executives report they expect to hire more employees over the next four months, a decrease from 35.7% in March. 51.9% expect no change in headcount over the next four months, a decrease from 57.1% last month. 14.8% expect to hire fewer employees, up from 7.1% in March.

- None of the leadership evaluate the current U.S. economy as “excellent,” down from 3.7% the previous month. 88.9% of the leadership evaluate the current U.S. economy as “fair,” unchanged from March. 11.1% evaluate it as “poor,” an increase from 7.4% last month.

- 7.4% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 3.6% in March. 48.2% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 53.6% last month. 44.4% believe economic conditions in the U.S. will worsen over the next six months, an increase from 42.9% the previous month.

- In April 37.0% of respondents indicate they believe their company will increase spending on business development activities during the next six months, down from 39.3% the previous month. 44.4% believe there will be “no change” in business development spending, down from 53.6% in March. 18.5% believe there will be a decrease in spending, up from 7.1% last month.

Survey Demographics

Market Segment

- Bank 48%

- Captive 12%

- Independent 40%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 15.3%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 46.1%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 38.4%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 15.4%

- $50 Million – $250 Million 19.2%.

- $250 Million – $1 Billion 26.9%

- Over $1 Billion 38.4%

April 2023 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“I think the general economy will have a downturn this year which is why we are focused on credit quality and portfolio performance. In this market change, opportunity exists and I am optimistic that Wintrust Specialty Finance is well positioned to step up to those opportunities.” David Normandin, President and Chief Executive Officer, Wintrust Specialty Finance

Bank, Middle Ticket

“KeyBank clients continue to have the confidence in Key to meet their needs from a cash management and lending perspective. While the economy has slowed, demand remains for financing important infrastructure and clean energy initiatives. We remain encouraged that as we move along 2023, Key Equipment Finance will continue to support capital equipment acquisitions, technology efficiency investments and, ultimately, a rebound in most of our sectors.” Adam Warner, President, Key Equipment Finance

Back to Top