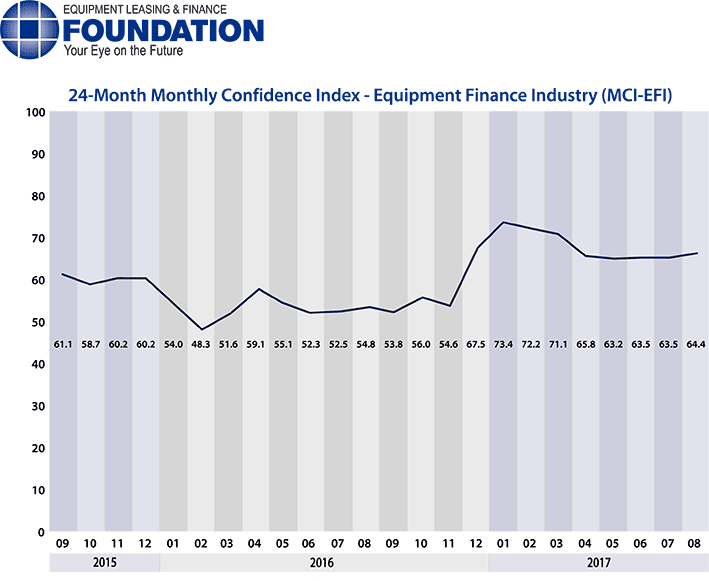

The Equipment Leasing & Finance Foundation (the Foundation) releases the August 2017 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 64.4 in August, up from 63.5 the previous two months.

When asked about the outlook for the future, MCI-EFI survey respondent Thomas Jaschik, President, BB&T Equipment Finance, said, “The political dysfunction in Washington continues to stifle the U.S. economy. Despite this lack of leadership the equipment finance industry has experienced solid growth in 2017. However, with some action on tax and regulatory reform the economy and equipment finance industry could greatly accelerate.”

Survey Results

The overall MCI-EFI is 64.4, up from 63.5 the previous two months.

• When asked to assess their business conditions over the next four months, 38.2% of executives responding said they believe business conditions will improve over the next four months, an increase from 30.3% in July. 61.8% of respondents believe business conditions will remain the same over the next four months, a decrease from 69.7% in July. None believe business conditions will worsen, unchanged from the previous month.

• 38.2% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 39.4% in July. 58.8% believe demand will “remain the same” during the same four-month time period, up from 57.6% the previous month. 2.9% believe demand will decline, relatively unchanged from 3% who believed so in July.

• 17.7% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 15.2% in July. 82.4% of executives indicate they expect the “same” access to capital to fund business, down from 84.9% last month. None expect “less” access to capital, unchanged from last month.

• When asked, 41.2% of the executives report they expect to hire more employees over the next four months, an increase from 33.3% in July. 55.9% expect no change in headcount over the next four months, a decrease from 66.7% last month. 2.9% expect to hire fewer employees, an increase from none in July.

• None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from last month. 100% of the leadership evaluate the current U.S. economy as “fair,” and none evaluate it as “poor,” both also unchanged from July.

• 23.5% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 24.2% in July. 76.5% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 75.8% the previous month. None believe economic conditions in the U.S. will worsen over the next six months, unchanged from last month.

• In August, 38.2% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 36.6% in July. 58.8% believe there will be “no change” in business development spending, down from 63.6% the previous month. 2.9% believe there will be a decrease in spending, an increase from none last month.

Survey Demographics

Market Segment

- Bank 72.73%

- Captive 6.06%

- Financial Services 3.03%

- Independent 18.18%

- Other 0.00%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 21.21%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 42.42%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 36.36%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0.00%

Organization Size

- Under $50 Million 3.03%

- $50 Million – $250 Million 15.15%

- $250 Million – $1 Billion 36.36%

- Over $1 Billion 45.45%

Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Independent, Small Ticket

“We are seeing continued steady demand with our customers mostly seeking to finance replacement equipment rather than for expansion plans. The ‘chaos’ in Washington gives no confidence to the small business owner who needs to gain a better sense of the future in order to invest in hiring and equipment.” Valerie Hayes Jester, President, Brandywine Capital Associates

Bank, Middle Ticket

“The economic and business positives far outweigh any negatives about the near-term future of the equipment finance industry.” Harry Kaplun, President, Specialty Finance, Frost Bank

Bank, Large Ticket

“The pricing environment remains very favorable for lessees. There are concerns about lack of progress in Washington surrounding tax policies.” Thomas Partridge, President, Fifth Third Equipment Finance

Back to Top