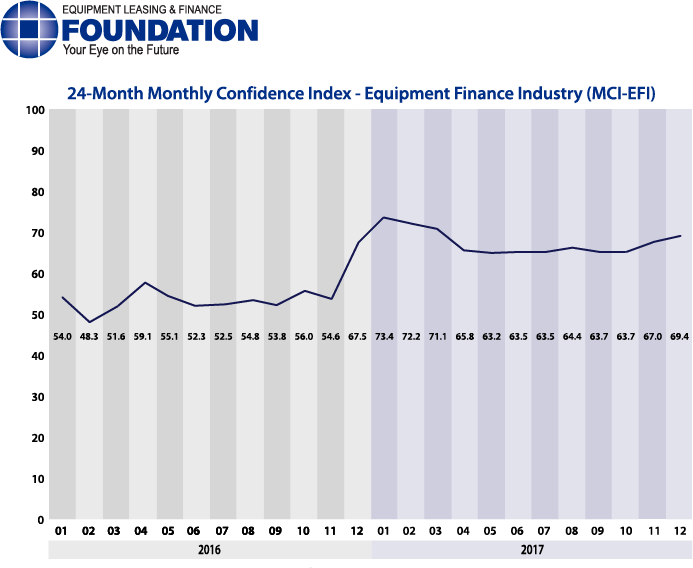

The Equipment Leasing & Finance Foundation (the Foundation) releases the December 2017 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 69.4 in December, an increase from 67.0 in November and the highest level in nine months.

When asked about the outlook for the future, MCI-EFI survey respondent Frank Campagna, Group Vice President, Line of Business Manager, M&T Bank Commercial Equipment Finance, said, “A number of factors enter into our optimism regarding an improved business environment, however, the anticipated removal of uncertainty regarding accounting rule and tax code changes are key events. Aligned with this optimism is our expansion into new business silos to take advantage of a resurgence of business in key sectors of our large ticket model. Our ability to drive higher returns through niche markets has encouraged the bank to increase its investment in our business providing a strong commitment to growth.”

December 2017 Survey Results

The overall MCI-EFI is 69.4 in December, up from 67.0 in November.

- When asked to assess their business conditions over the next four months, 32.1% of executives responding said they believe business conditions will improve over the next four months, relatively unchanged from 32.4% in November. 67.9% of respondents believe business conditions will remain the same over the next four months, also relatively unchanged from 67.7% the previous month. None believe business conditions will worsen, also unchanged from the previous month.

- 46.4% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from 35.3% in November. 53.6% believe demand will “remain the same” during the same four-month time period, down from 64.7% the previous month. None believe demand will decline, unchanged from November.

- 25.0% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 29.4% in November. 67.9% of executives indicate they expect the “same” access to capital to fund business, relatively unchanged from 67.7% last month. 7.1% expect “less” access to capital, up from none last month.

- When asked, 53.6% of the executives report they expect to hire more employees over the next four months, an increase from 35.5% in November. 46.4% expect no change in headcount over the next four months, a decrease from 61.8% last month. None expect to hire fewer employees, a decrease from 2.9% in November.

- 10.7% of the leadership evaluate the current U.S. economy as “excellent,” down from 17.7% last month. 89.3% of the leadership evaluate the current U.S. economy as “fair,” an increase from 82.4% in November. None evaluate it as “poor,” unchanged from last month.

- 42.9% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 32.5% in November. 57.1% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 64.7% the previous month. None believe economic conditions in the U.S. will worsen over the next six months, a decrease from 2.9% who believed so in November.

- In December, 57.1% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 52.9% in November. 42.9% believe there will be “no change” in business development spending, a decrease from 47.1% the previous month. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment

- Bank 71.43%

- Captive 3.57%

- Financial Services 0.00%

- Independent 21.43%

- Other (please specify) 3.57%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 17.86%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 50.00%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 32.14%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0.00%

Organization Size

- Under $50 Million 3.57%

- $50 Million – $250 Million 10.71%

- $250 Million – $1 Billion 35.71%

- Over $1 Billion 50.00%

December 2017 Survey Comments from Industry Executive Leadership

Independent, Small Ticket

“Getting resolution to federal tax reform is encouraging. Lower taxes on pass-through and corporations should boost confidence.” David T. Schaefer, CEO, Mintaka Financial, LLC

Bank, Small Ticket

“The combination of consumer spending, low interest rates and the tax cut for businesses—assuming it gets enacted—will create capex in the business sector. The political climate is still the wildcard that is going to make decision makers pause.” Paul Menzel, President & CEO, Financial Pacific Leasing, Inc., an Umpqua Bank Company

Bank, Middle Ticket

“The House and Senate have both passed tax packages which reduce the corporate tax rate and accelerate the depreciation of equipment. Both of these initiatives should provide a stimulus to the demand for equipment leasing and finance. If a final tax package similar to those passed by both house of congress are enacted, 2018 could be a breakout year for the equipment finance industry.” Thomas Jaschik, President, BB&T Equipment Finance

Back to Top