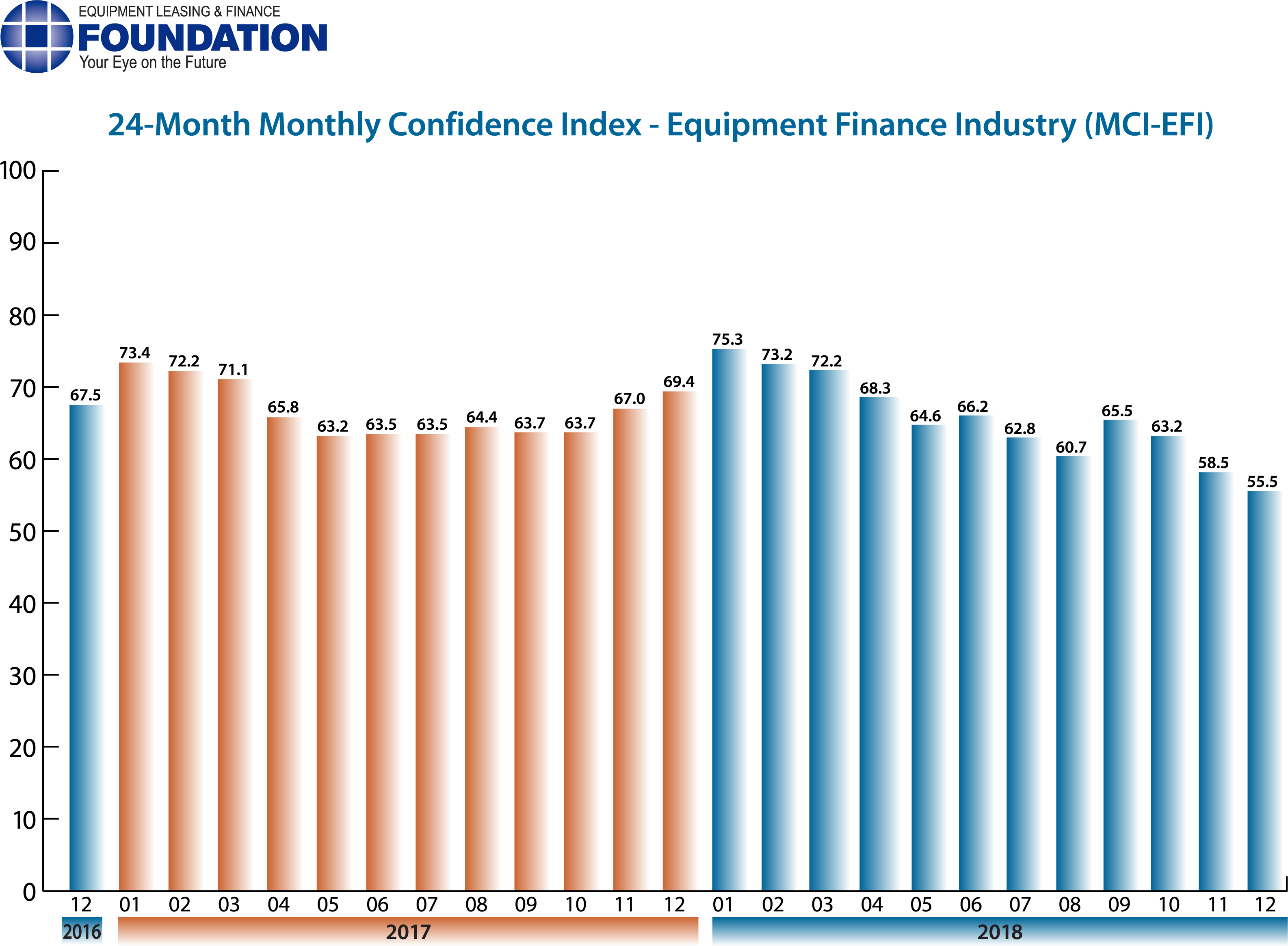

The Equipment Leasing & Finance Foundation (the Foundation) releases the December 2018 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market eased again in December to 55.5, a decrease from the November index of 58.5.

When asked about the outlook for the future, MCI-EFI survey respondent Valerie Hayes Jester, President, Brandywine Capital Associates, said, “We are experiencing a strong close to the year. Many of our customers are expanding their businesses and therefore investing in equipment for the long term. 2019 is looking a bit unstable at the moment. The manic stock market coupled with uncertain tariff and trade policies seem to be indicating economic instability for the coming year. The sector of the industry we service really mirrors consumer sentiment. The last 30 days have shown that the drivers to that market may be losing momentum. Couple that with potentially rising interest rates and tax benefits that are short lived, and we may see a slowdown in the near future.”

December 2018 Survey Results

The overall MCI-EFI is 55.5, a decrease from 58.5 in November.

- When asked to assess their business conditions over the next four months, 13.8% of executives responding said they believe business conditions will improve over the next four months, an increase from 10.7% in November. 65.5% of respondents believe business conditions will remain the same over the next four months, a decrease from 78.6% the previous month. 20.7% believe business conditions will worsen, an increase from 10.7% who believed so the previous month.

- 3.5% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 7.1% in November. 79.3% believe demand will “remain the same” during the same four-month time period, a decrease from 82.1% the previous month. 17.2% believe demand will decline, up from 10.7% who believed so in November.

- 17.2% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 14.3% in November. 75.9% of executives indicate they expect the “same” access to capital to fund business, a decrease from 85.7% last month. 6.9% expect “less” access to capital, up from none last month.

- When asked, 44.8% of the executives report they expect to hire more employees over the next four months, an increase from 42.9% in November. 44.8% expect no change in headcount over the next four months, a decrease from 46.4% last month. 10.3% expect to hire fewer employees, down slightly from 10.7% last month.

- 41.4% of the leadership evaluate the current U.S. economy as “excellent,” a decrease from 57.1% in November. 58.6% of the leadership evaluate the current U.S. economy as “fair,” an increase from 42.9% last month. None evaluate it as “poor,” unchanged from last month.

- 10.7% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 3.6% in November. 53.6% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 78.6% the previous month. 35.7% believe economic conditions in the U.S. will worsen over the next six months, an increase from 17.9% in November.

- In December, 42.9% of respondents indicate they believe their company will increase spending on business development activities during the next six months, 57.1% believe there will be “no change” in business development spending, and none believe there will be a decrease in spending, all unchanged from last month.

Survey Demographics

Market Segment

- Bank 67.8%

- Captive 10.7%

- Financial Services 3.5%

- Independent 14.3%

- Other 3.5%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 20.6%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 48.3%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 31.3%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0.00%

Organization Size

- Under $50 Million 7%

- $50 Million – $250 Million 13.8%

- $250 Million – $1 Billion 24%

- Over $1 Billion 55%

December 2018 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“Clearly our country’s economic and trade policies are drifting with uncertainty. Only urgent and necessary capex will occur while businesses postpone major investment. Growth will muddle along in the near term. Interest rates will stay fairly flat along with low inflation. Conditions for our industry will be okay.” Paul Menzel, CLFP, President and CEO, Financial Pacific Leasing, Inc., an Umpqua Bank Company

Independent, Small Ticket

“I’m optimistic that inflation hasn’t reared its head, and that we’ve withstood most of the tariffs without major sector damage. I continue to worry about the ballooning deficit with no plan in the foreseeable future to address it.” Quentin Cote, CLFP, President, Mintaka Financial, LLC

Bank, Middle Ticket

“Customers are still consuming the benefits of leasing under tax reform. As the dust settles we expect leasing to play an increasing role for equipment and facility financing.” Michael Romanowski, President, Farm Credit Leasing Services Corporation

Back to Top