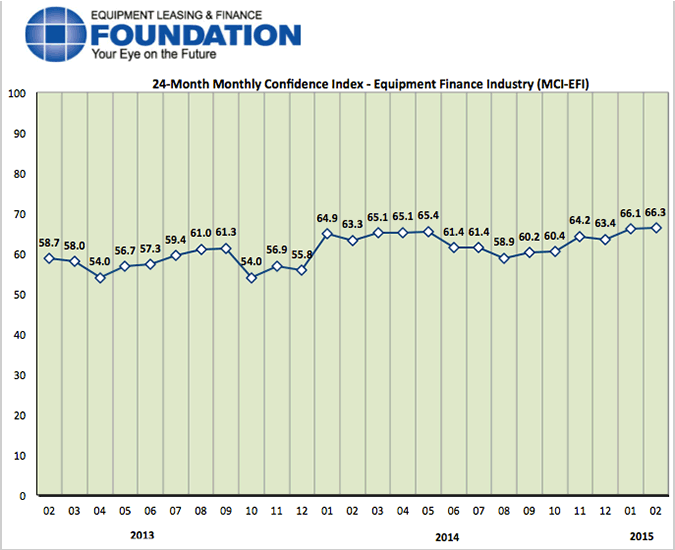

The Equipment Leasing & Finance Foundation (the Foundation) releases the February 2015 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $903 billion equipment finance sector. Overall, confidence in the equipment finance market is 66.3, a slight increase from the three-year high level reached by the January index of 66.1.

When asked about the outlook for the future, MCI-EFI survey respondent William Verhelle, Chief Executive Officer, First American Equipment Finance, a City National Bank Company, said, “The economy continues to improve. First American is seeing increased equipment acquisition activity among the large corporate borrowers we serve. We are optimistic that lower energy costs, if they remain at current low levels, will drive increased U.S. economic activity in the second half of 2015. We are more optimistic about the U.S. economy today than we have been at any time during the past six years.”

February 2015 Survey Results

The overall MCI-EFI is 66.3, a slight increase from the January index of 66.1.

- When asked to assess their business conditions over the next four months, 30.3% of executives responding said they believe business conditions will improve over the next four months, up from 23.3% in January. 63.6% of respondents believe business conditions will remain the same over the next four months, down from 76.7% in January. 6.1% believe business conditions will worsen, up from none who believed so the previous month.

- 42.4% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 20% in January. 51.5% believe demand will “remain the same” during the same four-month time period, down from 80% the previous month. 6.1% believe demand will decline, up from none in January.

- 27.3% of executives expect more access to capital to fund equipment acquisitions over the next four months, down from 33.3% in January. 72.7% of survey respondents indicate they expect the “same” access to capital to fund business, up from 66.7% in January. None expect “less” access to capital, unchanged from the previous month.

- When asked, 39.4% of the executives reported they expect to hire more employees over the next four months, a decrease from 50% in January. 57.6% expect no change in headcount over the next four months, up from 50% last month. 3% expect to hire fewer employees, up from none who expected fewer in January.

- 6.1% of the leadership evaluate the current U.S. economy as “excellent,” up from 3% last month. 90.9% of the leadership evaluate the current U.S. economy as “fair,” down from 97% in January. 3% rate it as “poor,” up from none the previous month.

- 45.4% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 43.3% who believed so in January. 54.6% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, down from 56.7% in January. None believe economic conditions in the U.S. will worsen over the next six months, unchanged from last month.

- In February, 48.5% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 50% in January. 51.5% believe there will be “no change” in business development spending, an increase from 50% last month. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment:

- Bank: 66.7%

- Captive: 6.1%

- Financial Services: 9.1%

- Independent: 18.2%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 9.1%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 57.6%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 33.3%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 6.1%

- $50 Million – $250 Million: 12.1%

- $250 Million – $1 Billion: 30.0%

- Over $1 Billion: 46.7%

February 2015 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Independent, Small Ticket

“Demand remains moderate and competition is strong. We remain bullish for 2015 as we expand channels and products. We are planning on muted GDP so we are focused on making our own opportunities versus waiting for the general economy to expand.” David Schaefer, CEO, Mintaka Financial, LLC

Bank, Small Ticket

“Things just seem to be better. Gas prices and unemployment are headed in the right direction. [I am] concerned over the negative effect of lower gas prices, i.e., higher fail rates of energy loans and energy stock value.” Kenneth Collins, CEO, Susquehanna Commercial Finance, Inc.

Bank, Middle Ticket

“I see continued strength in the transportation segment of the economy. That segment of our business will remain strong. The opportunities in oil and gas have substantially declined. I expect the decline to depress the volume of business during 2015. 2015 will be a mixed year with some industries doing well and others in decline.” Elaine Temple, President, BancorpSouth Equipment Finance

Bank, Middle Ticket

“All signs have been pointing to a ‘break-out’ year in 2015. However, investment in capital assets continues to be sporadic. Companies continue to be cautious in expanding their production capacity. Let’s hope the economists are correct in their predictions for 2015.” Thomas Jaschik, President, BB&T Equipment Finance

Back to Top