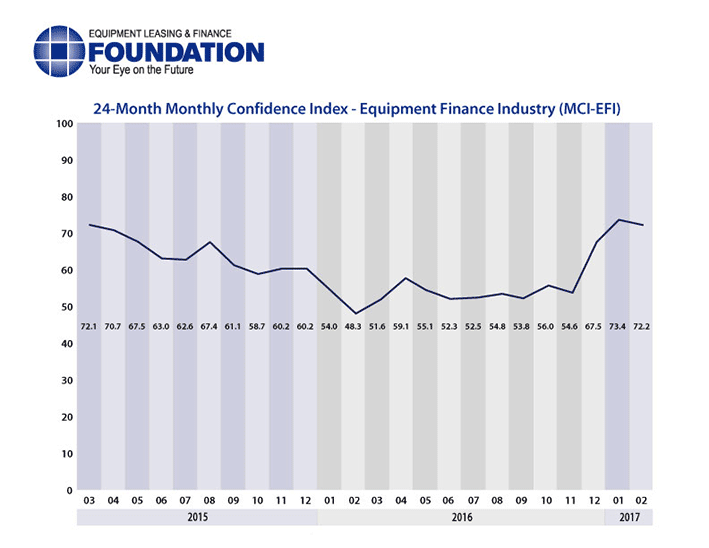

The Equipment Leasing & Finance Foundation (the Foundation) releases the February 2017 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 72.2, leveling off after January’s all-time high index of 73.4.

When asked about the outlook for the future, MCI-EFI survey respondent Thomas Partridge, President, Fifth Third Equipment Finance, said, “With the commitment of the Trump Administration to reduce regulation we expect more companies to start thinking more about expansion and the growth of their business versus a focus on regulatory compliance. Longer term concerns are over the direction of tax policies and their impact on the equipment finance industry. Any movement toward expensing capital expenditures could impact our industry. We think this is more of a 2018 issue than a 2017 issue.”

February 2017 Survey Results

The overall MCI-EFI is 72.2, a decrease from the January index of 73.4.

- When asked to assess their business conditions over the next four months, 69.2% of executives responding said they believe business conditions will improve over the next four months, a decrease from 74.2% in January. 26.9% of respondents believe business conditions will remain the same over the next four months, an increase from 22.6% in January. 3.8% believe business conditions will worsen, an increase from 3.2% the previous month.

- 53.8% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 71.0% in January. 42.3% believe demand will “remain the same” during the same four-month time period, up from 25.8% the previous month. 3.8% believe demand will decline, up from 3.2% who believed so in January.

- 15.4% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, a decrease from 19.4% who expected more in January. 84.6% of executives indicate they expect the “same” access to capital to fund business, an increase from 80.6% the previous month. None expect “less” access to capital, unchanged from last month.

- When asked, 42.3% of the executives report they expect to hire more employees over the next four months, an increase from 35.5% in January. 50.0% expect no change in headcount over the next four months, a decrease from 61.3% last month. 7.7% expect to hire fewer employees, up from 3.2% in January.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from last month. 100.0% of the leadership evaluate the current U.S. economy as “fair,” and none evaluate it as “poor,” both also unchanged from January.

- 73.1% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 61.3% in January. 26.9% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 38.7% the previous month. None believe economic conditions in the U.S. will worsen over the next six months, unchanged from last month.

- In February, 65.4% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 58.1% in January. 34.6% believe there will be “no change” in business development spending, a decrease from 41.9% the previous month. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment:

- Bank: 61.5%

- Captive: 7.7%

- Financial Services: 3.8%

- Independent: 26.9%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 19.2%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 46.2%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 34.6%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size:

- Under $50 Million: 7.7%

- $50 Million – $250 Million: 15.4%

- $250 Million – $1 Billion: 26.9%

- Over $1 Billion: 50.0%

February 2017 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Independent, Small Ticket

“We start the year with cautious optimism. Transaction flow is consistent; projects that had been placed on hold by our customers seem to be moving forward. I am concerned that the political environment is still distractive and the flurry of activity in Washington since the inauguration is not providing the level of comfort we had hoped for from the current Administration. Portfolios continue to perform well. Yields are still under tremendous pressure. 2017 will continue the trend of favorable credit windows and rates for customers looking to finance equipment.” Valerie Hayes Jester, President, Brandywine Capital Associates

Bank, Middle Ticket

“We continue to support our customers as they traverse through a low dollar commodity cycle. There have been some improvement on input costs, but challenges continue resulting in lower capex for many of our customers.” Michael Romanowski, President, Farm Credit Leasing Services Corporation

Bank, Middle Ticket

“For the first time in a decade we are seeing a pro-business environment. Overall, the political atmosphere, economic conditions and world matters are improving.” Harry Kaplun, President, Specialty Finance, Frost Bank

Back to Top