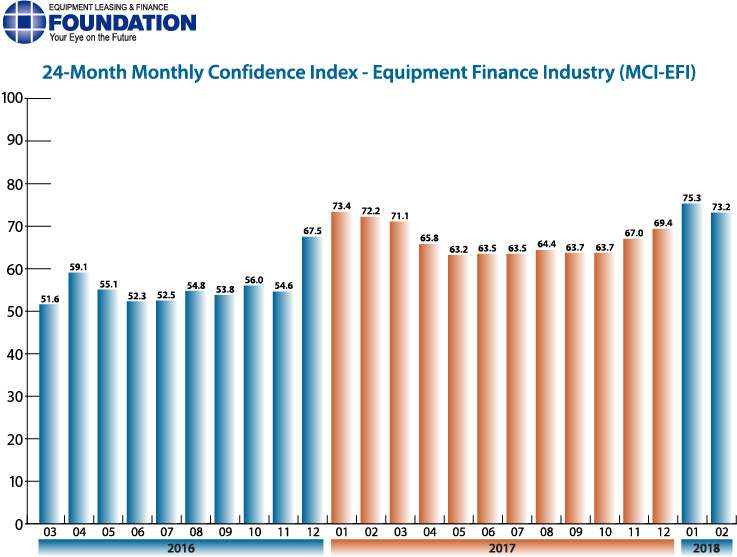

The Equipment Leasing & Finance Foundation (the Foundation) releases the February 2018 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 73.2 in February, easing from 75.3 in January, which was an all-time high level for the index.

When asked about the outlook for the future, MCI-EFI survey respondent Valerie Hayes Jester, President, Brandywine Capital Associates, said, “Our strong start to the year could be tempered with the recent volatility of the stock market and overall fears of rate increases. I believe by the end of the quarter we will have a strong picture regarding demand for the year. At this point, indications look favorable for continued positive trends in equipment acquisition and for financing for those transactions.”

February 2018 Survey Results

The overall MCI-EFI is 73.2 in February, easing from 75.3 in January.

- When asked to assess their business conditions over the next four months, 46.4% of executives responding said they believe business conditions will improve over the next four months, a decrease from 67.7% in January. 53.6% of respondents believe business conditions will remain the same over the next four months, an increase from 29% the previous month. Non believe business conditions will worsen, down from 3.2% who believed so the previous month.

- 67.6% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, relatively unchanged from 67.7% in January. 32.1% believe demand will “remain the same” during the same four-month time period, up from 29.0% the previous month. None believe demand will decline, a decrease from 3.2% who believed so in January.

- 28.6% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 35.5% in January. 67.9% of executives indicate they expect the “same” access to capital to fund business, an increase from 61.3% last month. 3.6% expect “less” access to capital, up from 3.2% last month.

- When asked, 42.9% of the executives report they expect to hire more employees over the next four months, an increase from 41.9% in January. 53.6% expect no change in headcount over the next four months, a decrease from 54.8% last month. 3.6% expect to hire fewer employees, up from 3.2% in January.

- 25.0% of the leadership evaluate the current U.S. economy as “excellent,” down from 25.8% last month. 75.0% of the leadership evaluate the current U.S. economy as “fair,” up from 74.2% in January. None evaluate it as “poor,” unchanged from last month.

- 60.7% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 61.3% in January. 35.7% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 38.7% the previous month. 3.6% believe economic conditions in the U.S. will worsen over the next six months, an increase from none in January.

- In February, 53.6% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 61.3% in January. 46.4% believe there will be “no change” in business development spending, an increase from 35.5% the previous month. None believe there will be a decrease in spending, a decrease from 3.2% last month.

Survey Demographics

Market Segment

- Bank 67.86%

- Captive 10.71%

- Financial Services 3.57%

- Independent 17.86%

- Other (please specify) 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 10.71%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 53.57%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 35.71%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0.00%

Organization Size

- Under $50 Million 7.14%

- $50 Million – $250 Million 10.71%

- $250 Million – $1 Billion 25.00%

- Over $1 Billion 57.14%

February 2018 Survey Comments from Industry Executive Leadership

Independent, Small Ticket

“Fundamentals in the United States and around the world are stable, which will provide a good business environment for financial services. Yet to be determined are the impacts of tax reform on capex and rising interest rates on markets in genera.” Paul Menzel, President and CEO, Financial Pacific Leasing, Inc., an Umpqua Bank Company

Bank, Small Ticket

“Tax reform and general market conditions have driven confidence levels very high.” David Normandin, CLFP, Managing Director, Commercial Finance Group, Hanmi Bank

Bank, Middle Ticket

“We are actively talking with partners and customers regarding the impact of tax reform and how best to structure transactions to meet their business objectives and maximize the benefits of tax reform. We expect this year to be a transition year to ‘New Normal’.” Michael Romanowski, President, Farm Credit Leasing Services Corporation

Back to Top