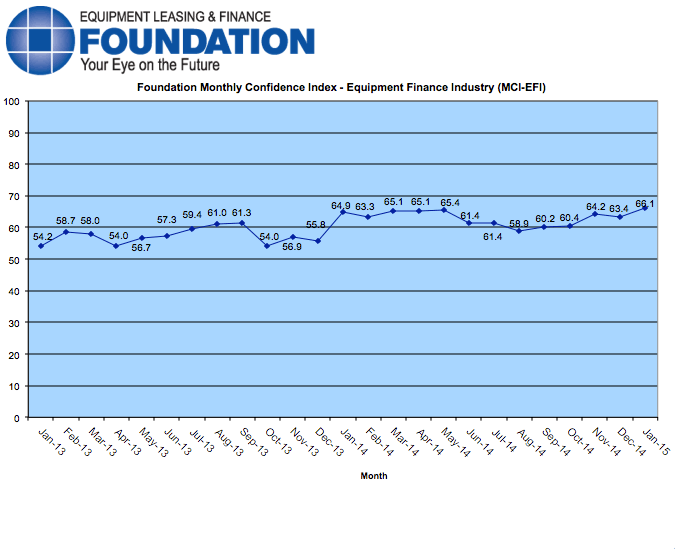

The Equipment Leasing & Finance Foundation (the Foundation) releases the January 2015 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $903 billion equipment finance sector. Overall, confidence in the equipment finance market is 66.1, an increase from the December index of 63.4 and the highest level in the last three years.

When asked about the outlook for the future, MCI-EFI survey respondent Thomas Jaschik, President, BB&T Equipment Finance, said, “With third quarter GDP in excess of 5 percent, the economy is primed for a surge in capital equipment spending. I believe domestic companies now have the confidence to make substantial investments in plant and equipment to facilitate growth. This could lead to a record year for equipment finance in 2015.”

January 2015 Survey Results

The overall MCI-EFI is 66.1, an increase from the December index of 63.4.

- When asked to assess their business conditions over the next four months, 23.3% of executives responding said they believe business conditions will improve over the next four months, down from 28% in December. 76.7% of respondents believe business conditions will remain the same over the next four months, up from 72% in December. None believe business conditions will worsen, unchanged from the previous month.

- 20% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 22% in December. 80% believe demand will “remain the same” during the same four-month time period, up from 72% the previous month. None believe demand will decline, down from 6.3% in December.

- 33.3% of executives expect more access to capital to fund equipment acquisitions over the next four months, up from 22% in December. 66.7% of survey respondents indicate they expect the “same” access to capital to fund business, down from 78% in December. None expect “less” access to capital, unchanged from the previous month.

- When asked, 50% of the executives reported they expect to hire more employees over the next four months, an increase from 43.8% in December. 50% expect no change in headcount over the next four months, unchanged from last month. None expect fewer employees, down from 6.3% in December.

- 3% of the leadership evaluate the current U.S. economy as “excellent,” unchanged from last month. 97% of the leadership evaluate the current U.S. economy as “fair,” and none rate it as “poor,” both also unchanged from December.

- 43.3% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 47% who believed so in December. 56.7% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, up from 53% in December. None believe economic conditions in the U.S. will worsen over the next six months, unchanged from last month.

- In January, 50% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 37.5% in December. 50% believe there will be “no change” in business development spending, a decrease from 62.5% last month. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment:

- Bank: 70.0%

- Captive: 3.3%

- Financial Services: 10.0%

- Independent: 16.7%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 10.0%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 53.3%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 36.7%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 6.7%

- $50 Million – $250 Million: 16.7%

- $250 Million – $1 Billion: 30.0%

- Over $1 Billion: 46.7%

January 2015 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Independent, Small Ticket

“We ended the year with a strong transaction backlog. We are experiencing more opportunities associated with business expansion rather than for replacement equipment. As we enter the new year we hope that our new Congress will help to break the logjam of political uncertainty that can provide a drag to even fairly robust demand. Margin also continues to be a negative factor as more and more liquidity enters our marketplace.” Valerie Hayes Jester, President, Brandywine Capital Associates, Inc.

Bank, Small Ticket

“[There is] parent willingness and desire to grow assets. My concern has always been the uncertainty around the world centered on the instability in certain regions.” Kenneth Collins, CEO, Susquehanna Commercial Finance, Inc.

Bank, Middle Ticket

“General economic conditions continue to improve. Sentiment has finally started to turn positive. We are beginning to see more new equipment financing projects across most of our business segments.” William Verhelle, Chief Executive Officer, First American Equipment Finance

Bank, Middle Ticket

“The rapid decline in oil prices has created a new uncertainty. While the decline has both a negative and positive effect on various business sectors, its overall impact is unclear. This uncertainty will temper or eliminate many new business initiatives, reducing new equipment spending.” Harry Kaplun, President, Frost Equipment Leasing and Finance

Back to Top