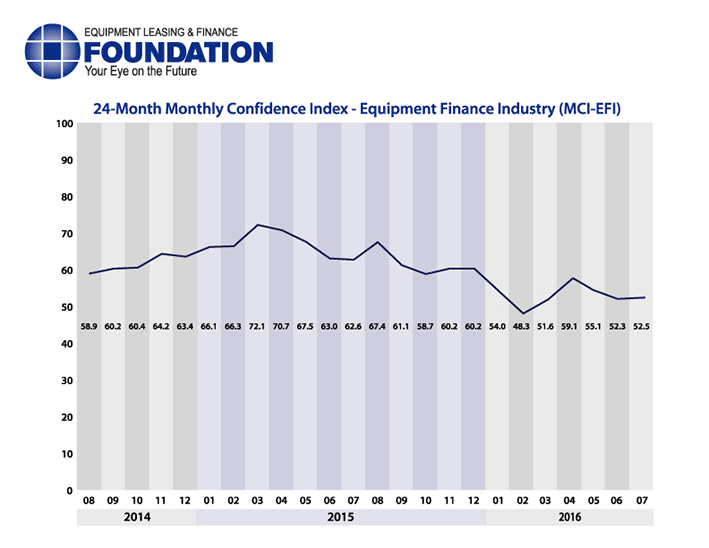

The Equipment Leasing & Finance Foundation (the Foundation) releases the July 2016 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 52.5, remaining steady with the June index of 52.3.

When asked about the outlook for the future, MCI-EFI survey respondent Anthony Cracchiolo, President and CEO, U.S. Bank Equipment Finance, said, “The industry continues to be stable and positioned for growth as the U.S. economy improves. However, challenges remain as the expansion remains slow and as low interest rates continue to apply pressure to the industry’s bottom line.”

July 2016 Survey Results

The overall MCI-EFI is 52.5, steady with the June index of 52.3.

- When asked to assess their business conditions over the next four months, 12.1% of executives responding said they believe business conditions will improve over the next four months, an increase from 9.4% in June. 75.8% of respondents believe business conditions will remain the same over the next four months, an increase from 68.8% in June. 12.1% believe business conditions will worsen, a decrease from 21.9% the previous month.

- 12.1% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from 6.3% in June. 57.6% believe demand will “remain the same” during the same four-month time period, down from 71.9% the previous month. 30.3% believe demand will decline, an increase from 21.9% who believed so in June.

- 15.2% of executives expect more access to capital to fund equipment acquisitions over the next four months, relatively unchanged from 15.6% in June. 78.8% of survey respondents indicate they expect the “same” access to capital to fund business, a decrease from 81.3% the previous month. 6.1% expect “less” access to capital, an increase from 3.1% last month.

- When asked, 30.3% of the executives report they expect to hire more employees over the next four months, a decrease from 37.5% in June. 63.6% expect no change in headcount over the next four months, an increase from 56.3% last month. 6.1% expect to hire fewer employees, unchanged from June.

- None of the leadership evaluates the current U.S. economy as “excellent,” unchanged from last month. 100.0% of the leadership evaluate the current U.S. economy as “fair,” an increase from 96.9% last month. None evaluates it as “poor,” a decrease from 3.1% in June.

- 3.0% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 6.5% in June. 78.8% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 75.0% the previous month. 18.2% believe economic conditions in the U.S. will worsen over the next six months, a slight decrease from 18.8% who believed so last month.

- In July, 36.4% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 31.3% in June. 60.6% believe there will be “no change” in business development spending, a decrease from 68.8% the previous month. 3.0% believe there will be a decrease in spending, an increase from none who believed so last month.

Survey Demographics

Market Segment:

- Bank: 63.6%

- Captive: 6.1%

- Financial Services: 6.1%

- Independent: 24.2%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 15.2%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 45.5%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 39.4

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 6.1%

- $50 Million – $250 Million: 12.1%

- $250 Million – $1 Billion: 33.3%

- Over $1 Billion: 48.5%

July 2016 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Independent, Small Ticket

“Current events here and abroad make us concerned about demand for the next two quarters. Application volume has remained steady but not strong, and credit approval percentages are decreasing slightly. I think our average customer will wait for the outcome of the election before making decisions to expand their business or replace equipment that may be ready for an upgrade. Uncertainty seems to plague us.” Valerie Hayes Jester, President, Brandywine Capital Associates, Inc.

Independent, Middle Ticket

“There is definitely uncertainty given the international effects that Brexit has had on exchange and bond rates. The question is how it will affect the U.S. market, which continues to plow ahead, albeit at a slow pace.” William H. Besgen, Senior Advisor, Vice Chairman Emeritus, Hitachi Capital America Corp.

Bank, Middle Ticket

“The political and economic environments will continue to create uncertainly for the foreseeable future. As such, investment in capital equipment will continue to be erratic. I would expect a bumpy ride for the equipment finance industry for the remainder of 2016.” Thomas Jaschik, President, BB&T Equipment Finance

Back to Top