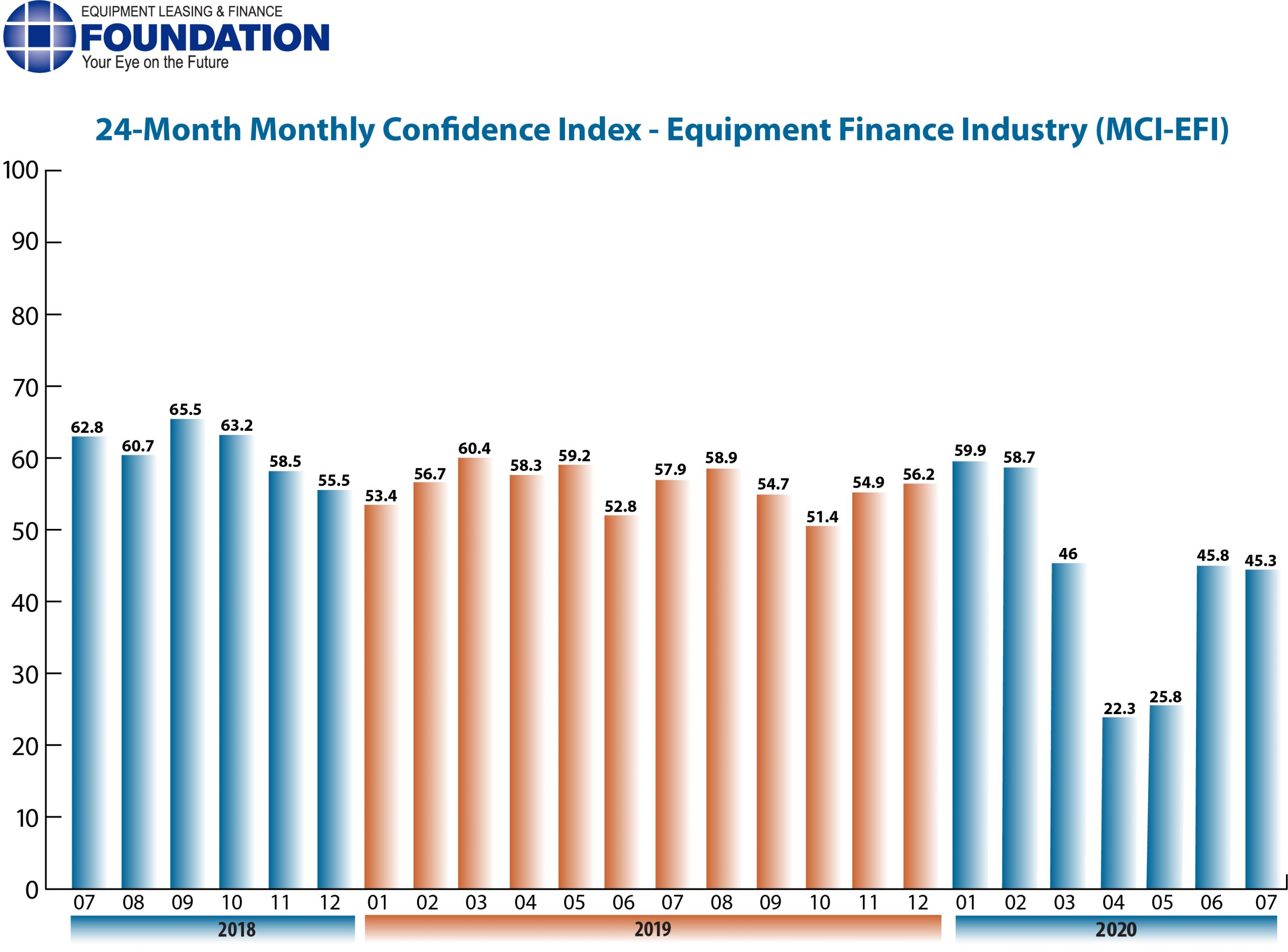

The Equipment Leasing & Finance Foundation (the Foundation) releases the July 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 45.3, steady with the June index of 45.8.

The Foundation also releases highlights of the COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry.

When asked about the outlook for the future, MCI-EFI survey respondent Michael Romanowski, President, Farm Credit Leasing, said, “We continue to find solutions for our customers as they traverse through the COVID crisis. In some cases, we are providing leasing solutions to customers who have not considered leasing in the past. We expect these new relationships to continue to grow even after the pandemic has moved on.”

July 2020 Survey Results

The overall MCI-EFI is 45.3, steady with the June index of 45.8.

- When asked to assess their business conditions over the next four months, 21.4 of executives responding said they believe business conditions will improve over the next four months, down from 37% in June. 50% believe business conditions will remain the same over the next four months, an increase from 18.5% the previous month. 28.6% believe business conditions will worsen, a decrease from 44.4% in June.

- 14.3% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 18.5% in June. 64.3% believe demand will “remain the same” during the same four-month time period, an increase from 44.4% the previous month. 21.4% believe demand will decline, a decrease from 37% in June.

- 10.7% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 7.4 in June. 78.6% of executives indicate they expect the “same” access to capital to fund business, a decrease from 85.2% last month. 10.7% expect “less” access to capital, an increase from 7.4% the previous month.

- When asked, 7.1% of the executives report they expect to hire more employees over the next four months, relatively unchanged from 7.4% in June. 75% expect no change in headcount over the next four months, a decrease from 85.2% last month. 17.9% expect to hire fewer employees, up from 7.4% the previous month.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 39.3% of the leadership evaluate the current U.S. economy as “fair,” up from 22.2% in June. 60.7% evaluate it as “poor,” down from 77.8% last month.

- 25.9% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 55.6% in June. 55.6% indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 25.9% last month. 18.5% believe economic conditions in the U.S. will worsen over the next six months, unchanged from the previous month.

- In July, 21.4% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 14.8% last month. 57.1% believe there will be “no change” in business development spending, down from 74.1% in June. 21.4% believe there will be a decrease in spending, an increase from 11.1% last month.

July 2020 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“Business volume is strong and we are maintaining portfolio performance. Yields are better and COVID affected accounts continue to fall.” David Normandin, CLFP, President and CEO, Wintrust Specialty Finance

Independent, Small Ticket

“There’s little cause for optimism. I’m very concerned that continued coronavirus infections will cause rolling closures across the country.” Quentin Cote, CLFP, President, Mintaka Financial, LLC

Independent, Middle Ticket

“We are starting to see some spending, possibly pent-up demand, with businesses that had put acquisitions on hold at the onset of COVID-19. Stronger borrowers are looking to take advantage of the situation and tuck in, or otherwise acquire weaker competitors.” Bruce J. Winter, President, FSG Capital, Inc.

Back to Top