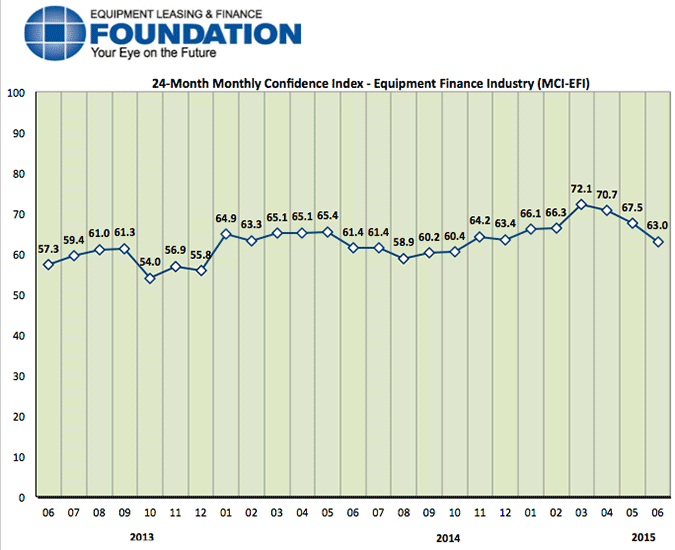

The Equipment Leasing & Finance Foundation (the Foundation) releases the June 2015 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $903 billion equipment finance sector. Overall, confidence in the equipment finance market is 63.0, easing from the May index of 67.5.

When asked about the outlook for the future, MCI-EFI survey respondent Thomas Jaschik, President, BB&T Equipment Finance, said, “I believe any rise in interest rates will spur activity within the equipment finance industry. Companies continue to defer capital expenditures as long as possible. A rise in interest rates will hopefully provide a catalyst to accelerate capital expenditures as costs may rise in the future.”

June 2015 Survey Results

The overall MCI-EFI is 63.0, an easing from the May index of 67.5.

- When asked to assess their business conditions over the next four months, 17.9% of executives responding said they believe business conditions will improve over the next four months, down from 30.8% in May. 82.1% of respondents believe business conditions will remain the same over the next four months, up from 69.2% in May. None believe business conditions will worsen, unchanged from the previous month.

- 21.4% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 34.6% in May. 78.6% believe demand will “remain the same” during the same four-month time period, up from 65.4% the previous month. None believe demand will decline, unchanged from May.

- 25% of executives expect more access to capital to fund equipment acquisitions over the next four months, down from 38.5% in May. 75% of survey respondents indicate they expect the “same” access to capital to fund business, up from 57.7% in May. None expect “less” access to capital, down from 3.9% who expected less access to capital the previous month.

- When asked, 57.1% of the executives reported they expect to hire more employees over the next four months, an increase from 53.9% in May. 35.7% expect no change in headcount over the next four months, down from 42.3% last month. 7.1% expect to hire fewer employees, up from 3.9% who expected fewer in May.

- 3.6% of the leadership evaluate the current U.S. economy as “excellent,” relatively unchanged from 3.9% last month. 96.4% of the leadership evaluate the current U.S. economy as “fair,” and none rate it as “poor,” both unchanged from the previous month.

- 28.6% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 34.6 % who believed so in May. 67.9% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 65.4% in May. 3.6% believe economic conditions in the U.S. will worsen over the next six months, an increase from none who believed so last month.

- In June, 35.7% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 50% in May. 60.7% believe there will be “no change” in business development spending, an increase from 46.2% last month. 3.6% believe there will be a decrease in spending, relatively unchanged from 3.9% who believed so last month.

Survey Demographics

Market Segment:

- Bank: 67.9%

- Captive: 7.1%

- Financial Services: 7.1%

- Independent: 17.9%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 10.7%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 53.6%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 32.1%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 3.6%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 3.6%

- $50 Million – $250 Million: 10.7%

- $250 Million – $1 Billion: 39.3%

- Over $1 Billion: 46.4%

June 2015 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Independent, Small Ticket

“Competition is robust due to new market entrants. Access to capital is abundant and new channels focused on end users are challenging us to adapt and change. Banks are actively looking to deploy capital. Secured and unsecured loan products are prevalent.” David Schaefer, CEO, Mintaka Financial, LLC

Bank, Small Ticket

“We are starting to see signs that both the consumer and businesses are starting to increase spending due to elevated confidence in the economy. If this ultimately occurs in tandem, we should see accelerating growth in equipment finance in the foreseeable future.” Paul Menzel, President & CEO, Financial Pacific Leasing, LLC

Bank, Middle Ticket

“The revised first quarter GDP showed economic contraction and economists have revised down their growth projections for the full year. This will likely mean that interest rates will be kept at these historically low levels for longer than expected, further pressuring interest margins.” Adam D. Warner, President, Key Equipment Finance and Immediate Past Chairman of the Equipment Leasing and Finance Association (ELFA)

Back to Top