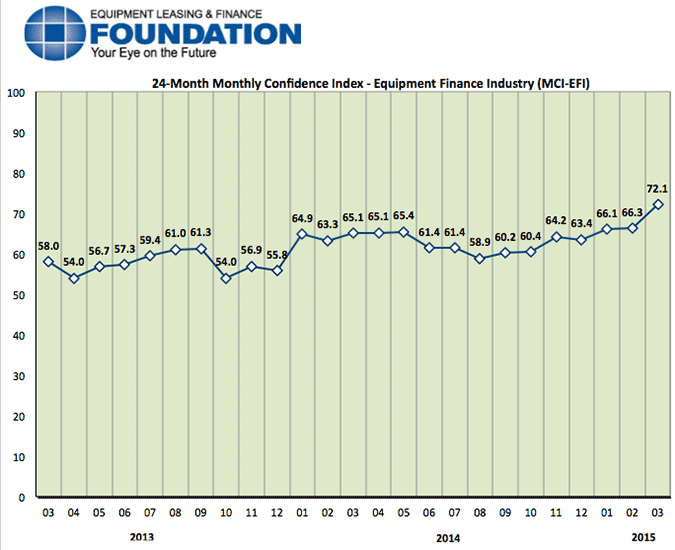

The Equipment Leasing & Finance Foundation (the Foundation) releases the March 2015 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $903 billion equipment finance sector. Overall, confidence in the equipment finance market is 72.1, the highest level in four years, and an increase from the February index of 66.3.

When asked about the outlook for the future, MCI-EFI survey respondent Harry Kaplun, President, Frost Equipment Leasing and Finance, said, “Equipment financing demand is continuing although there are increasing clouds of uncertainty. In particular the full impact of lower oil prices has not been seen. This favorable event for consumers has a mixed impact commercially.”

March 2015 Survey Results

The overall MCI-EFI is 72.1, an increase from the February index of 66.3.

- When asked to assess their business conditions over the next four months, 50% of executives responding said they believe business conditions will improve over the next four months, up from 30.3% in February. 50% of respondents believe business conditions will remain the same over the next four months, down from 63.6% in February. None believe business conditions will worsen, down from 6.1% who believed so the previous month.

- 41.7% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 42.4% in February. 58.3% believe demand will “remain the same” during the same four-month time period, up from 51.5% the previous month. None believe demand will decline, down from 6.1% in February.

- 25% of executives expect more access to capital to fund equipment acquisitions over the next four months, down from 27.3% in February. 75% of survey respondents indicate they expect the “same” access to capital to fund business, up from 72.7% in February. None expect “less” access to capital, unchanged from the previous month.

- When asked, 70.8% of the executives reported they expect to hire more employees over the next four months, an increase from 39.4% in February. 25% expect no change in headcount over the next four months, down from 57.6% last month. 4.2% expect to hire fewer employees, up from 3% who expected fewer in February.

- 12.5% of the leadership evaluate the current U.S. economy as “excellent,” up from 6.1% last month. 87.5% of the leadership evaluate the current U.S. economy as “fair,” down from 90.9% in February. None rate it as “poor,” down from 3% the previous month.

- 45.8% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, relatively unchanged from 45.5% who believed so in February. 54.2% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, unchanged from February. None believe economic conditions in the U.S. will worsen over the next six months, also unchanged from last month.

- In March, 58.3% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 48.5% in February. 41.7% believe there will be “no change” in business development spending, a decrease from 51.5% last month. None believe there will be a decrease in spending, unchanged from last month.

Survey Demographics

Market Segment:

- Bank: 75.0%

- Captive: 4.2%

- Financial Services: 8.3%

- Independent: 12.5%

- Other: 0.0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 8.3%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 66.7%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 25.0%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 0.0%

- $50 Million – $250 Million: 8.3%

- $250 Million – $1 Billion: 37.5%

- Over $1 Billion: 54.2%

March 2015 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Independent, Middle Ticket

“Our truck financing business continues to exceed budgeted expectations with monthly credit applications the highest in our 14 years of offering financing in this market. Our vendor truck manufacturers continue to be optimistic as well.” William Besgen, President & COO, Hitachi Capital America Corp.

Bank, Small Ticket

“Housing in certain parts of the South is booming. Rentals are up as well. The overall economy appears to be improving, but overregulation remains a concern.” Kenneth Collins, CEO, Susquehanna Commercial Finance, Inc.

Bank, Middle Ticket

“Economists will be playing catch-up for the balance of 2015 in order to achieve their consensus 3 percent growth in GDP. If we get there it will be a very good year for the equipment finance industry. So far, we are lagging behind.” Thomas Jaschik, President, BB&T Equipment Finance

Back to Top