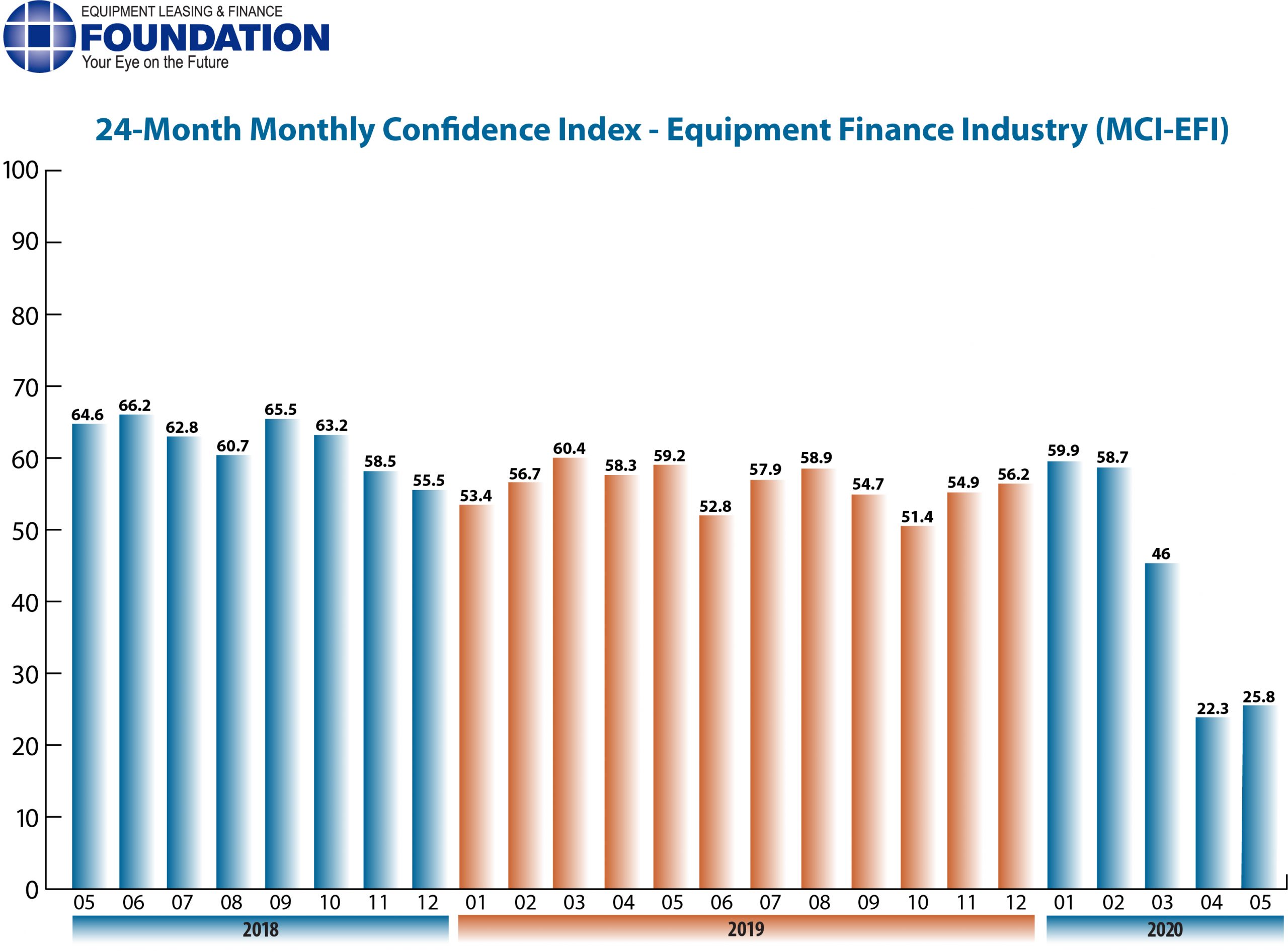

The Equipment Leasing & Finance Foundation (the Foundation) releases the May 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market improved with an index of 25.8, up from the historic low in April of 22.3.

The Foundation also releases highlights of its newly launched COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry.

When asked about the outlook for the future, MCI-EFI survey respondent Alan Sikora, CLFP, CEO, First American Equipment Finance, an RBC / City National Company, said, “While there is currently much uncertainty in the world, the U.S. equipment leasing and finance industry has a history of resiliency during times of crisis. We will get through this, and many companies will innovate and emerge stronger.”

May 2020 Survey Results

The overall MCI-EFI is 25.8, an increase from 22.3 in April.

- When asked to assess their business conditions over the next four months, 3.3% of executives responding said they believe business conditions will improve over the next four months, down from 6.9% in April. 10% believe business conditions will remain the same over the next four months, an increase from none the previous month. 86.7% believe business conditions will worsen, a decrease from 93.1% in April.

- 6.7% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, relatively unchanged from April. 6.7% believe demand will “remain the same” during the same four-month time period, an increase from 3.5% the previous month. 86.7% believe demand will decline, a decrease from 89.7% in April.

- None of the respondents expect more access to capital to fund equipment acquisitions over the next four months, unchanged from April. 73.3% of executives indicate they expect the “same” access to capital to fund business, an increase from 53.6% last month. 26.7% expect “less” access to capital, a decrease from 46.4% the previous month.

- When asked, 16.7% of the executives report they expect to hire more employees over the next four months, an increase from 6.9% in April. 60% expect no change in headcount over the next four months, a decrease from 69% last month. 23.3% expect to hire fewer employees, down from 24.1% the previous month.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 10% of the leadership evaluate the current U.S. economy as “fair,” up from none in April. 90% evaluate it as “poor,” down from 100% last month.

- 20% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 27.6% in April. 30% indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 6.9% last month. 50% believe economic conditions in the U.S. will worsen over the next six months, down from 65.5% the previous month.

- In May, 23.3% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 17.2% last month. 33.3% believe there will be “no change” in business development spending, down from 48.3% in April. 43.3% believe there will be a decrease in spending, an increase from 34.5% last month.

May 2020 Survey Comments from Industry Executive Leadership

Bank, Middle Ticket

“We are seeing opportunities with customers who have not leased with us in the past as they look to conserve working capital. We are seeing an increase in restructure requests and would expect restructure requests to continue for the balance of the year.” Michael Romanowski, President, Farm Credit Leasing

Independent, Middle Ticket

“The actions by Congress and the Federal Reserve have gone a long way to increasing confidence in our economy and financial markets. This will be a long road, with losers and winners, and only time will tell how our economy and way of life is changed after this health crisis is resolved.” Bruce J. Winter, President, FSG Capital, Inc.

Back to Top