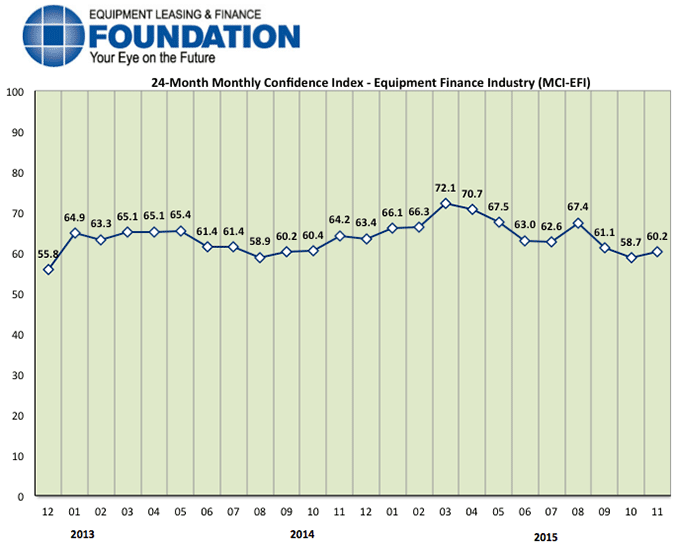

The Equipment Leasing & Finance Foundation (the Foundation) releases the November 2015 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1.046 trillion equipment finance sector. Overall, confidence in the equipment finance market is 60.2, an increase from the October index of 58.7.

When asked about the outlook for the future, MCI-EFI survey respondent David T. Schaefer, CEO, Mintaka Financial, LLC, said, “The most recent positive job creation report and the resolution of the leadership struggles in the House of Representatives should equate to more optimism and less uncertainty for small business owners and decision makers. I am more optimistic about the business environment.”

November 2015 Survey Results

The overall MCI-EFI is 60.2, an increase from the October index of 58.7.

- When asked to assess their business conditions over the next four months, 14.8% of executives responding said they believe business conditions will improve over the next four months, unchanged from October. 74.1% of respondents believe business conditions will remain the same over the next four months, a decrease from 77.8% in October. 11.1% believe business conditions will worsen, an increase from 7.4% the previous month.

- 22.2% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, unchanged from October. 66.7% believe demand will “remain the same” during the same four-month time period, down from 70.4% the previous month. 11.1% believe demand will decline, an increase from 7.4% who believed so in October.

- 22.2% of executives expect more access to capital to fund equipment acquisitions over the next four months, and 77.8% of survey respondents indicate they expect the “same” access to capital to fund business, both unchanged from October. None expect “less” access to capital, also unchanged from the previous month.

- When asked, 48.1% of the executives report they expect to hire more employees over the next four months, an increase from 40.7% in October. 48.1% expect no change in headcount over the next four months, down from 51.9% last month. 3.7% expect to hire fewer employees, down from 7.4% in October.

- 3.7% of the leadership evaluate the current U.S. economy as “excellent,” unchanged from last month. 92.6% of the leadership evaluate the current U.S. economy as “fair,” up from 88.9% in October. 3.7% rate it as “poor,” a decrease from 7.4% the previous month.

- 18.5% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 7.4% who believed so in October. 77.8% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, unchanged from the previous month. 3.7% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 14.8% who believed so last month.

- In November, 44.4% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 40.7% in October. 51.9% believe there will be “no change” in business development spending, a decrease from 59.3% last month. 3.7% believe there will be a decrease in spending, an increase from none last month.

Survey Demographics

Market Segment:

- Bank: 70.4%

- Captive: 3.7%

- Financial Services: 3.7%

- Independent: 18.5%

- Other: 3.7%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million): 11.1%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million): 51.9%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999): 37.0%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000): 0.0%

Organization Size (Based on Annual New Business Volume for Fiscal Year 2010):

- Under $50 Million: 7.4%

- $50 Million – $250 Million: 7.4%

- $250 Million – $1 Billion: 33.3%

- Over $1 Billion: 51.9%

November 2015 Survey Comments from Industry Executive Leadership

Depending on the market segment they represent, executives have differing points of view on the current and future outlook for the industry.

Independent, Small Ticket

“Demand has stabilized and appears to be increasing as the traditional year-end push for last minute acquisitions occurs. Pressure continues on margin and I do not see that changing in the near term. The marketplace is flooded with capital and as the industry continues to show strong portfolio performance, I do not expect the profitability dynamic to change.” Valerie Hayes Jester, President, Brandywine Capital Associates, Inc.

Bank, Small Ticket

“Year-end always provides optimism with an array of vendor specials and accountant suggested purchases. There may be more incentive to purchase this year with the lingering hints of rates increasing in 2016 becoming stronger. The absence of bonus depreciation may dampen this optimism some.” Daryn Lecy, Vice President of Operations, Stearns Bank, N.A. – Equipment Finance Division

Bank, Middle Ticket

“We continue to see investment by our customers for strategic based expenditures. We expect opportunities to continue through 2016.” Michael Romanowski, President, Farm Credit Leasing Services Corporation

Back to Top