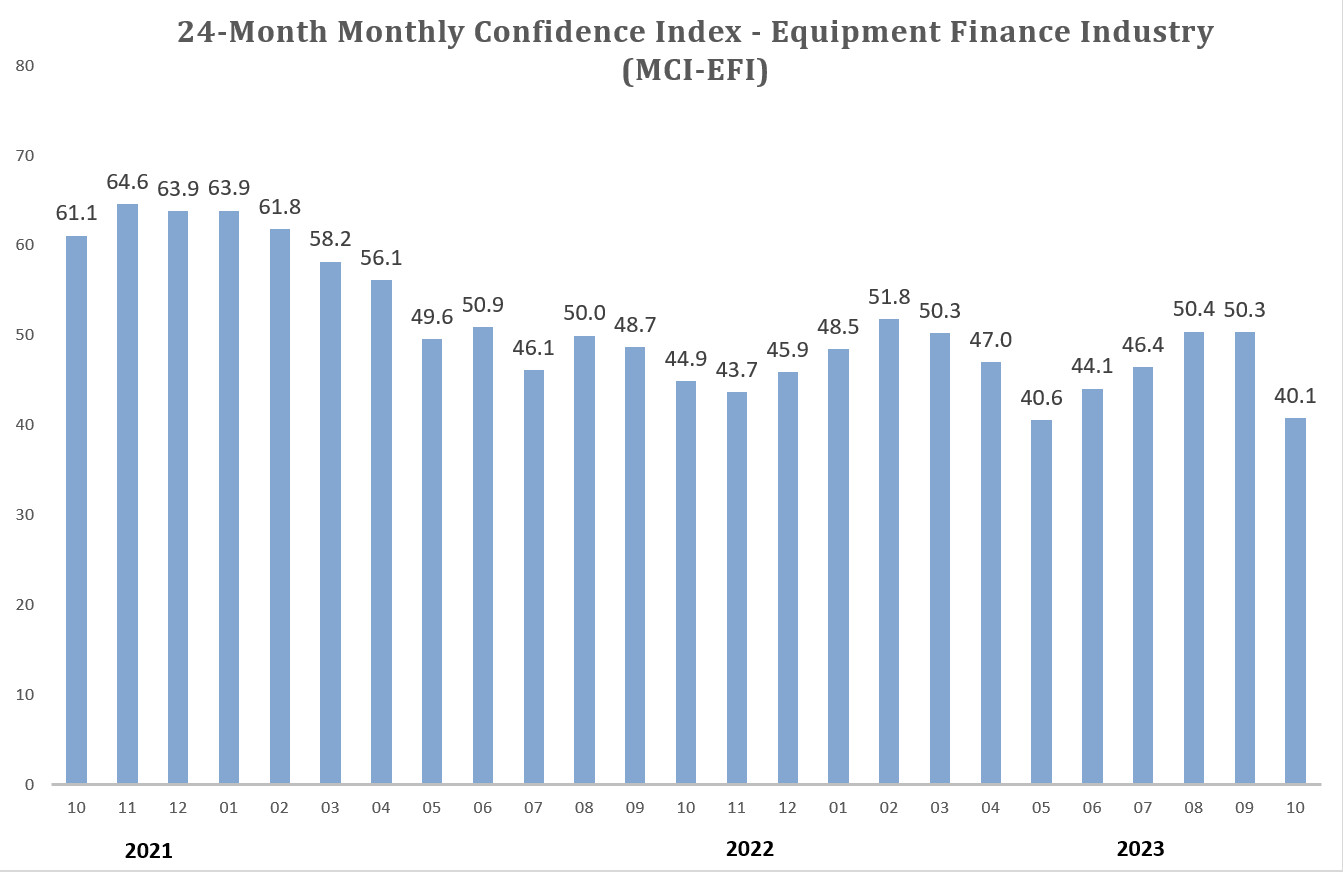

The Equipment Leasing & Finance Foundation (the Foundation) releases the October 2023 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 40.1, a decrease from the September index of 50.3.

When asked about the outlook for the future, MCI-EFI survey respondent Mark Bonanno, President and COO, North Mill Equipment Finance, said, “The macroeconomic environment remains challenging. The U.S. is facing the largest peacetime deficit ever. The likelihood of a government shutdown has increased due to U.S. political upheaval and the pending election cycle. Inflation remains significantly above Fed targets, and the possibility of interest rates going higher or remaining elevated for longer than expected is high, making a recession more likely than not.”

October 2023 Survey Results

The overall MCI-EFI is 40.1, a decrease from the September index of 50.3.

- When asked to assess their business conditions over the next four months, 3.7% of the executives responding said they believe business conditions will improve over the next four months, a decrease from 10.3% in September. 74.1% believe business conditions will remain the same over the next four months, down from 75.9% the previous month. 22.2% believe business conditions will worsen, an increase from 13.8% in September.

- 3.7% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 10.3% in September. 77.8% believe demand will “remain the same” during the same four-month time period, a decrease from 79.3% the previous month. 18.5% believe demand will decline, an increase from 10.3% in September.

- 14.8% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 13.8% in September. 70.4% of executives indicate they expect the “same” access to capital to fund business, down from 72.4% last month. 14.8% expect “less” access to capital, up from 13.8% the previous month.

- When asked, 14.8% of the executives report they expect to hire more employees over the next four months, a decrease from 20.7% in September. 70.4% expect no change in headcount over the next four months, up from 72.4% last month. 14.8% expect to hire fewer employees, up from 6.9% in September.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month. 92.6% of the leadership evaluate the current U.S. economy as “fair,” up from 89.7% in September. 7.4% evaluate it as “poor,” down from 10.3% last month.

- 3.9% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 6.9% in September. 57.7% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 62.1% last month. 38.5% believe economic conditions in the U.S. will worsen over the next six months, an increase from 31% the previous month.

- In October, 11.1% of respondents indicate they believe their company will increase spending on business development activities during the next six months, down from 24.1% the previous month. 77.8% believe there will be “no change” in business development spending, up from 69% in September. 11.1% believe there will be a decrease in spending, an increase from 6.9% last month.

Survey Demographics

Market Segment

- Bank 55.5%

- Captive 14.8%

- Independent 29.6%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 7.4%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 33.3%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 59.2%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 11.1%

- $50 Million – $250 Million 14.8%.

- $250 Million – $1 Billion 33.3%

- Over $1 Billion 40.7%

October 2023 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“The equipment finance industry will continue to flex to find the opportunities that exist in our current market and will find solutions to the challenges in pockets of the industry. I am confident that we will continue to grow profitably through this time.” David Normandin, President and Chief Executive Officer, Wintrust Specialty Finance

Independent, Small Ticket

“While we have avoided recession in 2023, there are a number of dark clouds on the horizon that could tip the scale, including the cumulative effect of higher interest rates, higher oil prices, the resumption of student loan payments and the ongoing risk of a government shutdown. Some, but certainly not all, of our customers are wary about the future and seem to be a little more skeptical on capital spending.” Bruce J. Winter, President, FSG Capital, Inc.

“When the auto union strike is settled, the result is likely going to include an increase in wages and benefits for the workers. An increase in inflation will follow.” James D. Jenks, CEO, Global Finance and Leasing Services, LLC

Back to Top