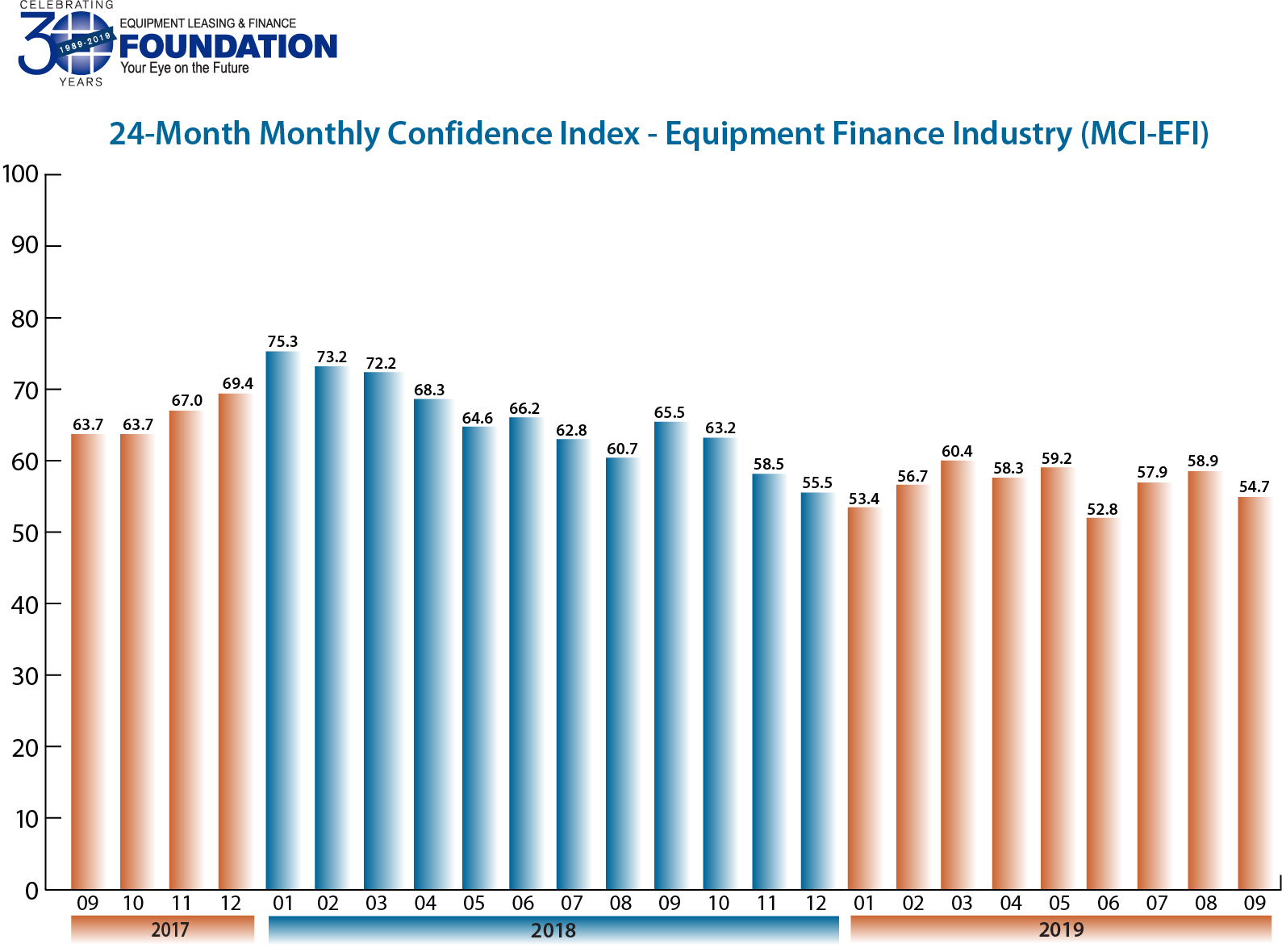

The Equipment Leasing & Finance Foundation (the Foundation) releases the September 2019 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 54.7, a decrease from the August index of 58.9.

When asked about the outlook for the future, MCI-EFI survey respondent Quentin Cote, CLFP, President, Mintaka Financial, LLC, said, “I’m optimistic about the health of the consumer confidence and unemployment rates. I’m very concerned about the real and psychic impacts of the trade wars on the economy and the size of the deficit limiting the government’s tools to keep the economy balanced.”

September 2019 Survey Results

The overall MCI-EFI is 54.7, a decrease from 58.9 in August.

- When asked to assess their business conditions over the next four months, 10.3% of executives responding said they believe business conditions will improve over the next four months, down from 16.7% in August. 75.9% of respondents believe business conditions will remain the same over the next four months, a decrease from 76.7% the previous month. 13.8% believe business conditions will worsen, up from 6.7% in August.

- 13.3% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, a decrease from 16.7% who believed so in August. 76.7% believe demand will “remain the same” during the same four-month time period, a decrease from 80% the previous month. 10% believe demand will decline, up from 3.3% in August.

- 16.7% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, 83.3% of executives indicate they expect the “same” access to capital to fund business, and none expect “less” access to capital, all unchanged from last month.

- When asked, 30% of the executives report they expect to hire more employees over the next four months, a decrease from 31% in August. 63.3% expect no change in headcount over the next four months, an increase from 62.1% last month. 6.7% expect to hire fewer employees, down slightly from 6.9% last month.

- 20% of the leadership evaluate the current U.S. economy as “excellent,” down from 36.7% in August. 80% of the leadership evaluate the current U.S. economy as “fair,” an increase from 60% the previous month. None evaluate it as “poor,” down from 3.3% in August.

- 3.3% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 6.7% in August. 70% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 73.3% the previous month. 26.7% believe economic conditions in the U.S. will worsen over the next six months, an increase from 20% in August.

- In September, 26.7% of respondents indicate they believe their company will increase spending on business development activities during the next six months, a decrease from 36.7% last month. 70% believe there will be “no change” in business development spending, an increase from 63.3% in August. 3.3% believe there will be a decrease in spending, up from none last month.

Survey Demographics

Market Segment

- Bank 66.6%

- Captive 10%

- Financial Services 3.3%

- Independent 20%

- Other 3.3%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 20%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 53.3%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 26.6%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0.00%

Organization Size

- Under $50 Million 6.67%

- $50 Million – $250 Million 13.3%

- $250 Million – $1 Billion 20%

- Over $1 Billion 60%

September 2019 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“Fundamental economic factors remain good and our overall business through the summer has been good. I am concerned that an overly negative tone being presented regarding the economy will have emotional results that fulfill that narrative.” David Normandin, CLFP, President and CEO, Wintrust Specialty Finance

Bank, Middle Ticket

“Tariffs continue to be the discussion with our customers. Belt tightening will continue until there is a light at the end of the tunnel. We expect investment in expansion to be muted until trade issues are resolved.” Michael Romanowski, President, Farm Credit Leasing

“Companies across many sectors continue to invest in capital equipment projects to compete and succeed.” Alan Sikora, CEO, First American Equipment Finance

Back to Top