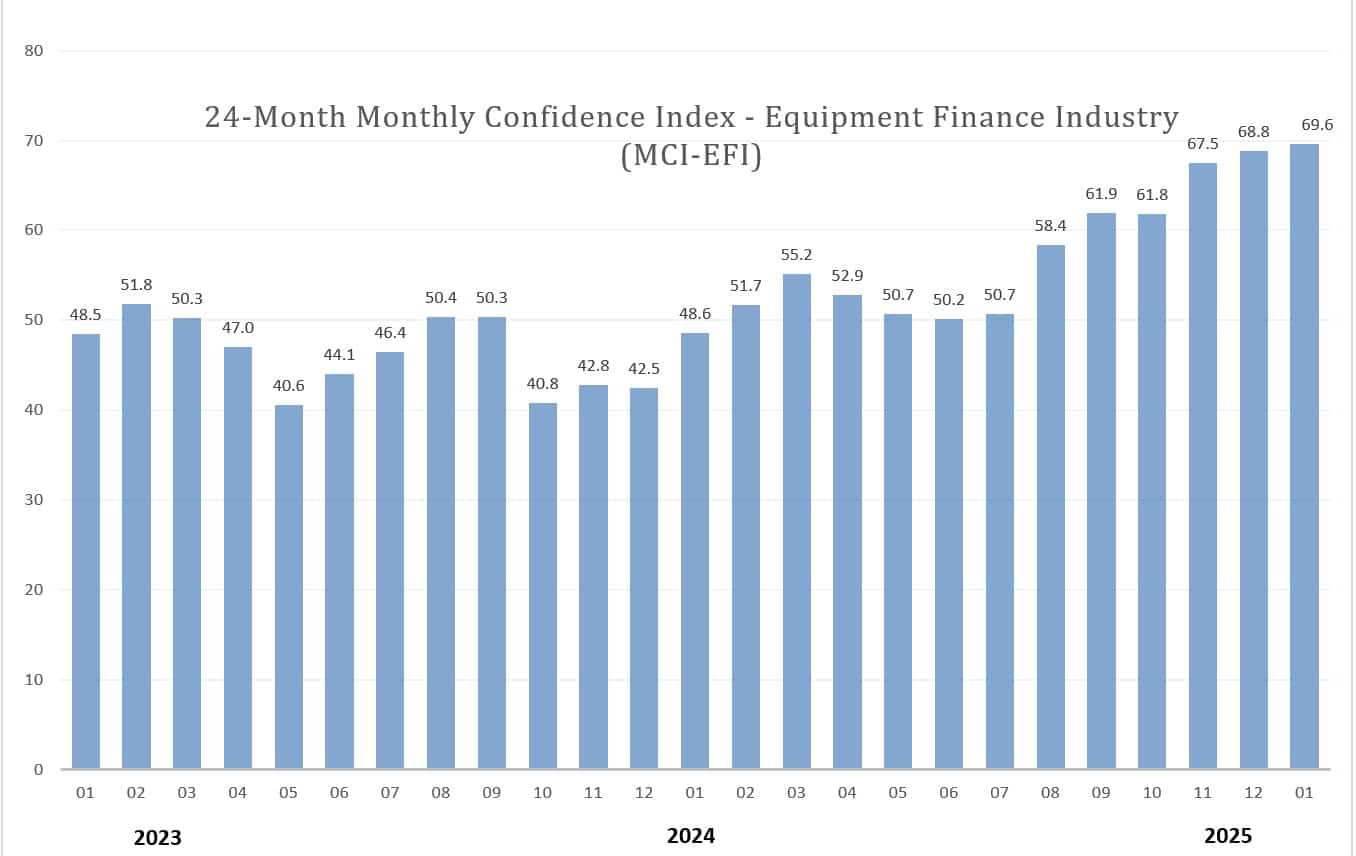

The Equipment Leasing & Finance Foundation (the Foundation) releases the January 2025 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Overall, confidence in the equipment finance market increased for the third consecutive month to 69.6, up from the December index of 68.8, and the highest level since July 2021. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future, as reported by key executives from the $1.3 trillion equipment finance sector.

When asked about the outlook for the future, MCI-EFI survey respondent William C. Perry III, Executive Vice President & Group Head, Regions Equipment Finance Corporation, said, “Encouraging data points clearly demonstrate the resiliency and critical role of equipment finance to the U.S. economy. As you consider further anticipated rate cut(s), capacity reshoring and the potential for 100% bonus depreciation being reinstated, we expect companies to increase investments in new technology, resources, and production equipment. This should equate to increased demand for structured leasing and equipment finance products as companies look to maximize associated tax benefits. Having performed well over the past 24 months, the equipment finance sector is justly poised for growth as we head into 2025 and beyond.”

January 2025 Survey Results

The overall MCI-EFI is 69.6, up from the December index of 68.8.

- Business conditions – When asked to assess their business conditions over the next four months, 57.1% of the executives responding said they believe business conditions will improve over the next four months, unchanged from December. 38.1% believe business conditions will remain the same over the next four months, up from 32.1% the previous month. 4.8% believe business conditions will worsen, down from 10.7% in December.

- Capex demand – 47.6% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 53.6% in December. 47.6% believe demand will “remain the same” during the same four-month time period, up from 42.9% the previous month. 4.8% believe demand will decline, an increase from 3.6% in December.

- Access to capital – 28.6% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, 71.4% of executives indicate they expect the “same” access to capital to fund business, and none expect “less” access to capital, all unchanged from the previous month.

- Employment – When asked, 47.6% of the executives report they expect to hire more employees over the next four months, an increase from 47.6% in December. 52.4% expect no change in headcount over the next four months, up from 42.9% last month. None expect to hire fewer employees, down from 10.7% in December.

- U.S. economy – 9.5% of the leadership evaluate the current U.S. economy as “excellent,” up from 7.1% the previous month. 85.7% evaluate the economy as “fair,” down from 89.3% in December. 4.8% evaluate it as “poor,” up from 3.6% last month.

- Economic outlook – 52.4% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, down from 53.6% in December. 47.6% indicate they believe the U.S. economy will “stay the same” over the next six months, up from 35.7% last month. None believe economic conditions in the U.S. will worsen over the next six months, a decrease from 10.7% the previous month.

- Business development spending – In January, 38.1% of respondents indicate they believe their company will increase spending on business development activities during the next six months, down from 46.4% the previous month. 61.9% believe there will be “no change” in business development spending, an increase from 50% in December. None believe there will be a decrease in spending, down from 3.6% last month.

Survey Demographics

Market Segment

- Bank 55%

- Captive 10%

- Independent 35%

- Other 0%

Market Segments Based on Transaction Size of New Business Volume

- Large-Ticket (New Business Volume Avg. Transaction Size Over $5 Million) 10%

- Middle-Ticket (New Business Volume Avg. Transaction Size of $250,000 – $5 Million) 45%

- Small-Ticket (New Business Volume Avg. Transaction Size of $25,000 – $249,999) 45%

- Micro-Ticket (New Business Volume Avg. Transaction Less Than $25,000) 0%

Organization Size

- Under $50 Million 9.5%

- $50 Million – $250 Million 14.3%.

- $250 Million – $1 Billion 42.8%

- Over $1 Billion 33.3%

January 2025 Survey Comments from Industry Executive Leadership

Bank, Small Ticket

“I think the incoming President and administration will promote a business-friendly atmosphere. This will hopefully boost confidence leading to business expansion and growth.” Charles Jones, Senior Vice President, 1st Equipment Finance, Inc.

“The equipment leasing and finance industry experienced a solid 2024 and is footed for a better 2025. Growth is back in the forecast with investments in many core industries projected in 2025. The opportunity is great and the obstacles are many, including continued normalization of portfolio performance as well as material increase in bankruptcy filings again in 2024 vs. 2023. Swap rates continue to be volatile and there is pressure in many SME organizations to maintain profitability. Our role in helping our customers acquire the equipment they need is real, and I am confident that we are up to the challenge of delivering creative and flexible solutions to meet our customers’ needs. David Normandin, CLFP, President and Chief Executive Officer, Wintrust Specialty Finance

Independent, Middle Ticket

“SLR Equipment Finance continues to evaluate opportunities to expand business in both its vendor, direct, and capital market spaces. Expected improvements in inflation, supply chain issue resolutions, expansion in energy sectors, and general trade improvements likely to occur over the course of 2025 should positively benefit capex spending, and therefore, the need to provide financing, especially by sources such as SLR Equipment Finance, which provides private capital and flexible options to its customers.” Shari Williams, Chief Risk Officer, SLR Equipment Finance

Independent, Large Ticket

“Equipment financing is an integral component of the middle market capital stack at this point as clients need access to cost-effective capital, and capex remains stable to strong. That said, there remain potential risks in the economy and geopolitical environment and things can turn suddenly.” Jonathan Albin, Chief Operating Officer, Nexseer Capital

Back to Top